USDSGD Technical Analysis

Contents

Introduction

The Singapore broker has seen the pair gain significantly as the central bank left its monetary policy setting unchanged. Also, the GDP had a good outcome according to the first quarter report of the year.

According to Song Seng Wun, an economist from Malaysia bank CIMB private bank sees Singapore’s economic trajectory because it depends on the effects and what happens on the COVID-19 outbreaks around the zones and on the global economic recovery.

Singapore Fundamentals

The Singapore GDP shows a surprising growth in the first quarter of the year 2021 compared to the previous year’s first-quarter report. It grew by 1.3% according to the Ministry of Trade and Industry.

Their report shows the highest growth rate in Singapore since the fourth quarter of 2019 and also about 0.2% expansion in industries.

However, the government is still warning their citizens concerning the uncertainties arising from the COVID-19 infection in the months to come but maintains its 2021 growth forecast between 4% to 6%.

Some sectors’ performance in the first quarter of 2021 is listed below.

Manufacturing sectors expanded by 10.7% because of stronger outputs in electronics, chemicals clusters and precision engineering. In construction, it contracted by 22.7% compared to last year due to a decline in both public and private projects. Also, service-producing industries shrank by 0.5% compared to the previous year.

Singaporean have been battling with COVID-19 like every other country in recent weeks, this has led the government to introduce a stricter restriction which will lead to the tightening of the domestic movement and border control that will affect segments of the economy and its foreign exchange.

US Fundamentals

Pending Homes Sales m/m

The report on numbers of homes to be sold that is still under contract but awaiting closing transactions excluding new constructions are released 28 days into the new month.

The sales of homes have a ripple effect on the economy and the health system is known because of the various transactions that take places from the mortgage bank to the brokers who execute the transaction.

If the outcome is greater than the forecast number, it is good for the currency but if not, it will lead the US dollar to be bearish. The previous data was 1.9% while the forecast is 0.6%.

USDSGD Technical Analysis

Long term Price Analysis

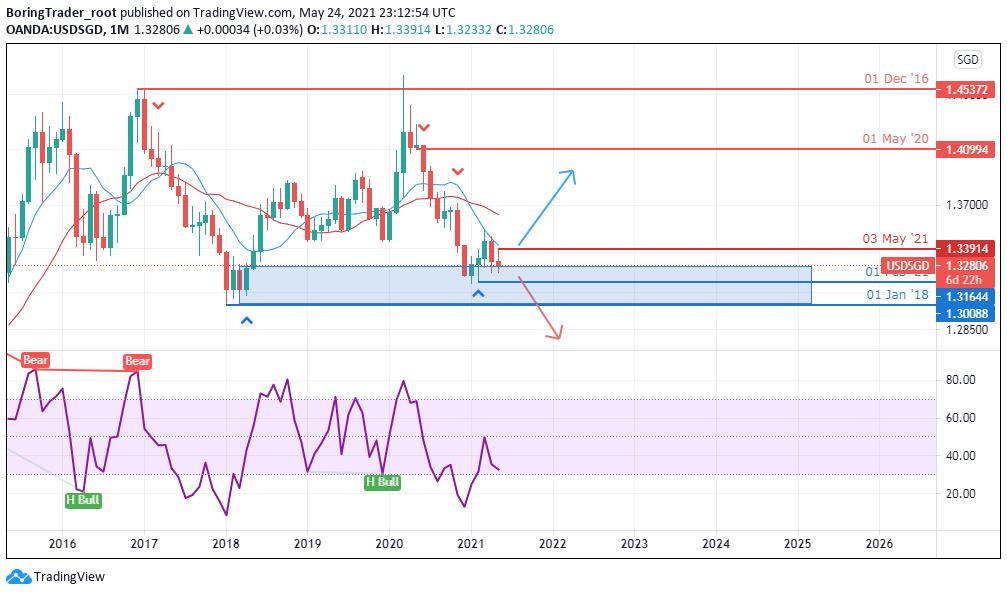

Monthly Outlook: Bearish Slowing within Significant Support Zone

Monthly Resistance Levels 1.45372, 1.40995

Monthly Support Levels 1.30089, 1.31645

The USDSGD pair has been a bearish trend amid the COVID-19 pandemic that weaken the US dollar globally while the foreign exchange of the Singapore dollar had been strong.

Looking at the monthly chart you can see that the pair is around the previous support zone of January 2018 (1.31645) where the Bulls could reject Bears from the zone previously.

If the Bull’s momentum is strong, we may see the price bounce from the zone in months to come.

The 1.3165 levels are psychological areas for the Bears and Bulls. If the bears can break down below the zone, we shall see the pair continue its down trend, creating a new low.

Weekly

Weekly Resistance Levels: 1.35328, 1.42722

Weekly Support Levels: 1.31578

On the weekly chart, the Singapore broker had been in a short position, having seen the pair making gains against the US dollar. The support level of 1.31578 has rejected the Bears twice previously, and it is facing another retest from the bears again.

The pair is in asymmetric triangle and the breakout could either be to the upside or to the downside of the chart.

As of last week, the Singapore Central Bank left its rates unchanged and other indices favoured the Singapore foreign exchange, giving it an edge over the US dollar.

A close below the low of 1.31578 we trigger selling pressure and the dollar will be weaker, but a failure to close will bring a reversal of the pair for a bullish run.

Daily Outlook: Bearish

Daily Resistance Levels: 1.35310, 1.3400, 1.34373

Daily Support Levels: 1.32341, 1.31649

The USDSGD daily chart is showing a ranging market between the bears and the Bulls as the price has been between the resistance level of 1.35310 and support level of 1.31649. If the current pressure from the bears reaches the 1.31649 level, we may get a reaction from the Bulls for another upward push.

Bullish Scenario:

The possible bullish scenario will be from the support zone of 1.31649 and 1.32341 if the bulls can overturn the bears pressure for a bullish surge in days to come.

Bearish Scenario:

The bears are still dominating the market and as they approach a psychological zone we expect them to get weakened. However, a close below the support will open another bearish swing.

Conclusion

The USDSGD pair is approaching a psychological zone in the market. A close below the zone will further increase the gains of the Singapore dollar against the US dollar. This will be a boost for the Singapore foreign exchange against the greenback in the financial market.

If the Bears cannot overturn the zones, we are likely to see the Bulls push the price out of the zone in the coming week.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: usdsgd