USD/SGD- Weekly Analysis for Singapore Binary Options

Contents

Fundamental

Not much has changed to the fundamental picture since our last analysis of the USDSGD pair 3 weeks ago. No major releases are on this week’s economic calendar and so USDSGD will likely remain range-bound for the remainder of the week. Markets are waiting for next Wednesday, February 28th which is expected to be a big day for the US Dollar when the new President Trump will address the Congress and will likely reveal the tax and fiscal plans advertised throughout his campaign. Where the US Dollar will trade in the next few weeks will primarily depend on President Trump reforms and the probabilities for another Fed rate hike.

Today the focus will be on the FOMC minutes. Investors will be looking for hawkish lines in the transcript, however, it’s likely that the minutes will be looked upon as dated and will not provide anything the market doesn’t expect given that chairwoman Yellen already spoke after the last Fed meeting at her semiannual testimony to Congress.

In addition later today before the release of the FOMC minutes, FOMC voting member Jerome H. Powell will speak. Tomorrow, February 23rd FOMC another voting member Robert Kaplan will speak publicly.

From Singapore on the calendar are the CPI report tomorrow and industrial production on Friday. The CPI number will be particularly important as the main driver for the weakness of the Singapore Dollar has been low inflation or deflation and subsequent monetary easing from its central bank in response. An uptick in inflation could provide a boost to the Singapore Dollar.

Technical

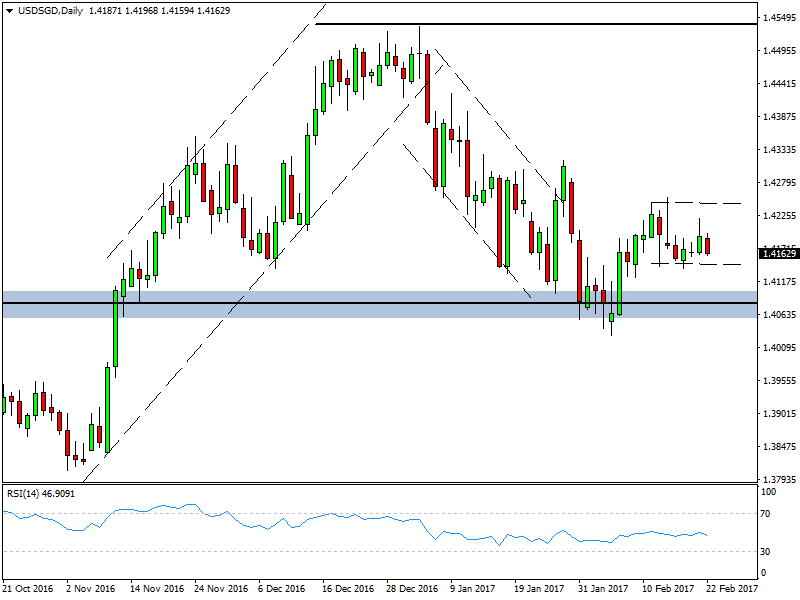

The picture on the daily timeframe is essentially unchanged after the slight rebound that we forecasted in our last report, with the only difference in that now USDSGD is trading in a 100-pips range of 1.4150 – 1.4250.

USDSGD Daily timeframe – Range trading right above support

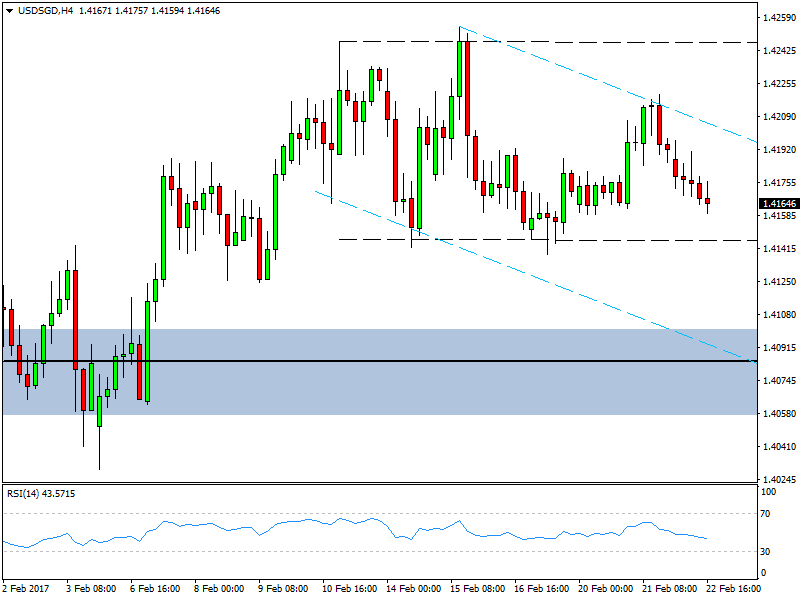

To zoom in on the range we can look at the 4h timeframe.

The strong support zone (blue shaded area) is some 100 pips below current levels. Also, Singapore binary options traders should keep an eye on the possibility of this horizontal range to become a downward channel (dotted blue lines) and reach the support zone again.

A bullish breakout of the horizontal range will most likely mean a continuation of the previous uptrend.

USDSGD 4h chart – Range intact – Decision time!

Our Recommended Singapore Binary Options Brokers to trade USDSGD:

Best Regulated Broker

IQ Option is the world’s leading EU regulated broker based with a revolutionary platform for all traders. Read IQ Option Review

- Best Trading App for Binary Options

- Minimum Deposit of only $10

- Minimum Trade of $1

- Trusted Broker

- $10,000 Virtual Funds ( Demo Account )

- Quick Withdrawals

- Outstanding Platform

- Weekly Tournaments

- Gain up to 98%*

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021