On Wednesday, a handful of fundamental data was released from the respective offices in the United Kingdom, including the average earnings index (3m/y) and official national unemployment rate.

Both of these fundamental indicators suggested that the UK’s economy did not perform up to the expectations of the binary options investors, as the average earnings index only increased by 3.2% against a forecast of 3.3% growth, and the official national unemployment rate increased to 5.6% against a previous forecast of 5.5% over the last month.

Hence, the fundamental outlook for the GBP/NZD has turned bearish for the next few days.

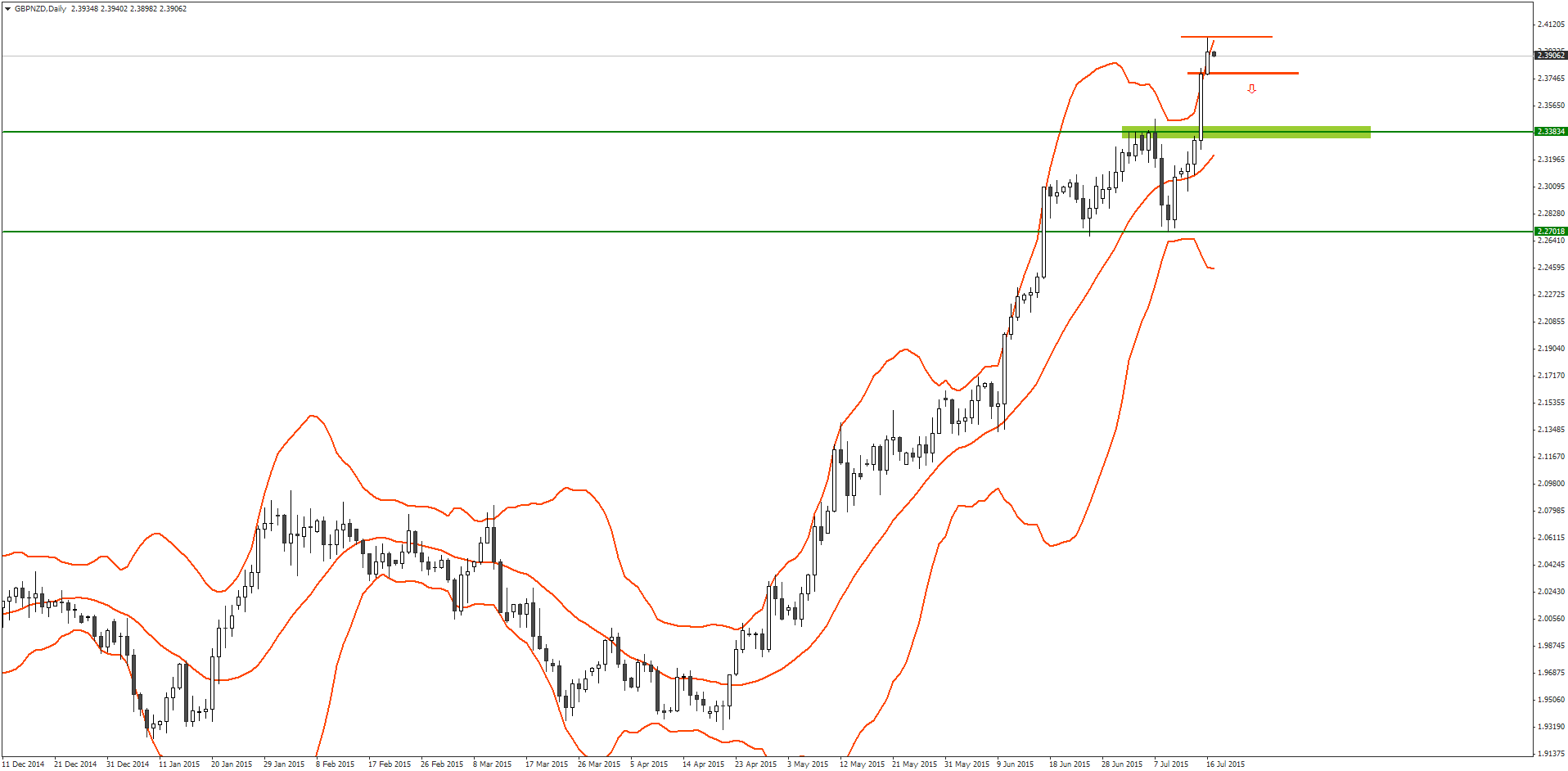

The GBPNZD has remained in a strong uptrend for the last two months since forming a bullish pin bar on April 21. During this timeframe, GBP/NZD gained over 4,500 pips. However, it is currently trading near the upper Bollinger Band.

Yesterday, we discussed a 60-second binary options strategy called BB 20 – 2.5, which uses the 2.5 Standard Deviation on the 20 period Bollinger Band. While it works on the 60-second timeframe, we can also apply this strategy on the longer time frame such as the daily charts as well.

Currently, the GBPNZD market condition appears to be in a perfect situation to apply the BB 20 – 2.5 binary options strategy.

The fundamental outlook for the GBP is currently bearish. In addition, the GBP/NZD price has touched the upper Bollinger Band with Standard Deviation (SD) 2.5 (20 period). Therefore, it may start a retrace soon; once the low of the previous bar is broken.

Under the circumstances, is recommended that traders place a PUT order for the GBP/NZD with their binary options brokers once the price penetrates below yesterday’s low, at 2.3776.

However, if the GBP/NZD price penetrates above yesterday’s high, at 2.4027, this signal would become invalid.

Recommended Binary Options Brokers

[bonustable_fixed site1=’8′ site2=’333′ site3=’120′ site4=’189′ ]Tagged with: Free Signal • GBP/NZD