Weekly EURUSD analysis

Contents

- EURUSD experiencing a market consolidation

- Time to be patient, especially for the long term traders.

- Formation of two hammers following each other in the weekly chart.

The EURUSD is on recess after a six month long bullish trend. This is reflected on every financial broker who has listed the currency pair even by brokers in Singapore. The currency pair has registered very little market movement this week with the average daily range being 500 points. This is quite odd for the EURUSD currency pair since it is one of the most volatile pairs and also the most traded.

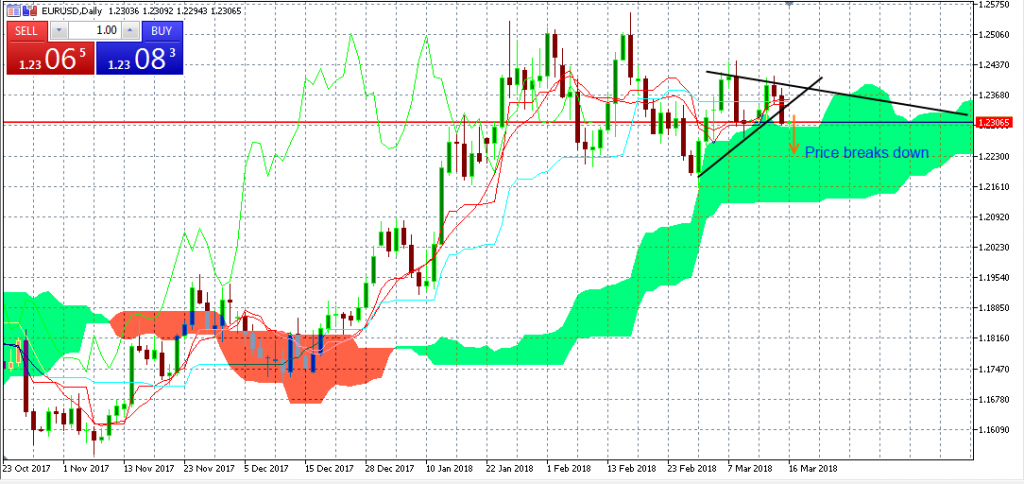

For day traders, a look at the daily chart would be very helpful.

Using the moving average and Ichimoku cloud indicators, the market shows a very week bullish trend; almost forming a market consolidation.

The market price is just above the green Ichimoku band and just about to fully cross the moving average downwards. Due to the market consolidation, the daily market range is very small.

But if you look at the general market trend, you shall realize that for every rise in the market price, there is retracement there afterwards. However, to be sure that it is time for the retracement, we applied triangle pattern and identified an ascending triangle pattern.

The price already broke the lower trend line of the ascending triangle meaning there is a bearish trend even if it is not for a long term. For the day traders, they can place a sell at the current price and place their target at around 1.22300.

You may ask why 1.22300? But when you closely look at the daily chart, you shall realize that this acts as the support level for the last two day wave patterns.

Weekly chart

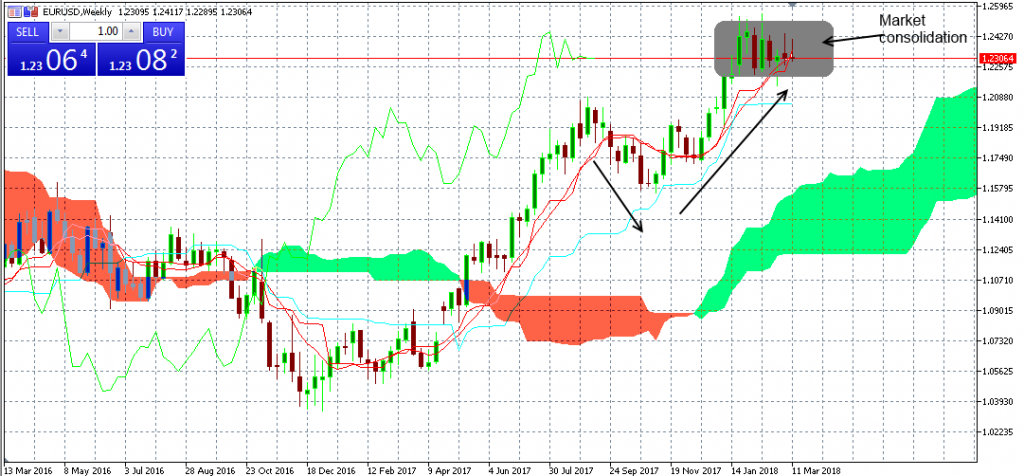

For the long term traders, the weekly chart is critical. It gives a wider overview of what is happening in the market.

Looking at the EURUSD weekly chart, the market price was on the rise for the last one and a half years (from December 2016 to date) although there have been slight retracements now and then.

For the last seven weeks, the market has been consolidating with no definite trend. The most amazing thing about the last two weeks is that the market has formed two consecutively. Although this is quite confusing, since there is no clear picture of which side the market may break, the best practice is placing an order after the market breaks.

Applying the Moving average, the market price has moved close to the MA and all lights are green for the prices crossing the moving average downwards. However, considering that the price is still too high above the green Ichimoku cloud, even if a retracement happened at the current price, it would drop to around 1.19185 before resuming its bullish trend.

Therefore, for now, long term traders will have to exercise their patience. It will pay off. By the end of this week, traders will have gotten the direction for the EURUSD. For traders in Singapore, they can easily trade the currency pair using the brokers in Singapore.

Our Recommended brokers in Singapore to trade EURUSD

Best Regulated Broker: IQ Option

IQ Option is the world’s leading EU regulated financial broker based with a revolutionary platform for all traders. Very popular for binary options & crypto trading. Read IQ Option review

- Best Trading App for Binary Options

- Minimum Deposit of only $10

- Minimum Trade of $1

- Trusted Broker

- $10,000 Virtual Funds ( Demo Account )

- Quick Withdrawals

- Outstanding Platform

- Weekly Tournaments

- Gain up to 98%*

Best Stock Broker

FirsTrade is a FINRA regulated stock trading broker based in New York ( USA ) than offers only $2.95 per trade in fees and good promotions . They provide great support to Chinese-speaking clients. Read FirsTrade review.

- US Regulated Stocks & Options Trading Platform

- Excellent English & Chinese support

- Low Fees of 2,95/Trade

- $0.50/ per options contract

- Get up to $300 Cash Rewards + 500 Free Trades

- No Minimum Deposit

DISCLAIMER

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021