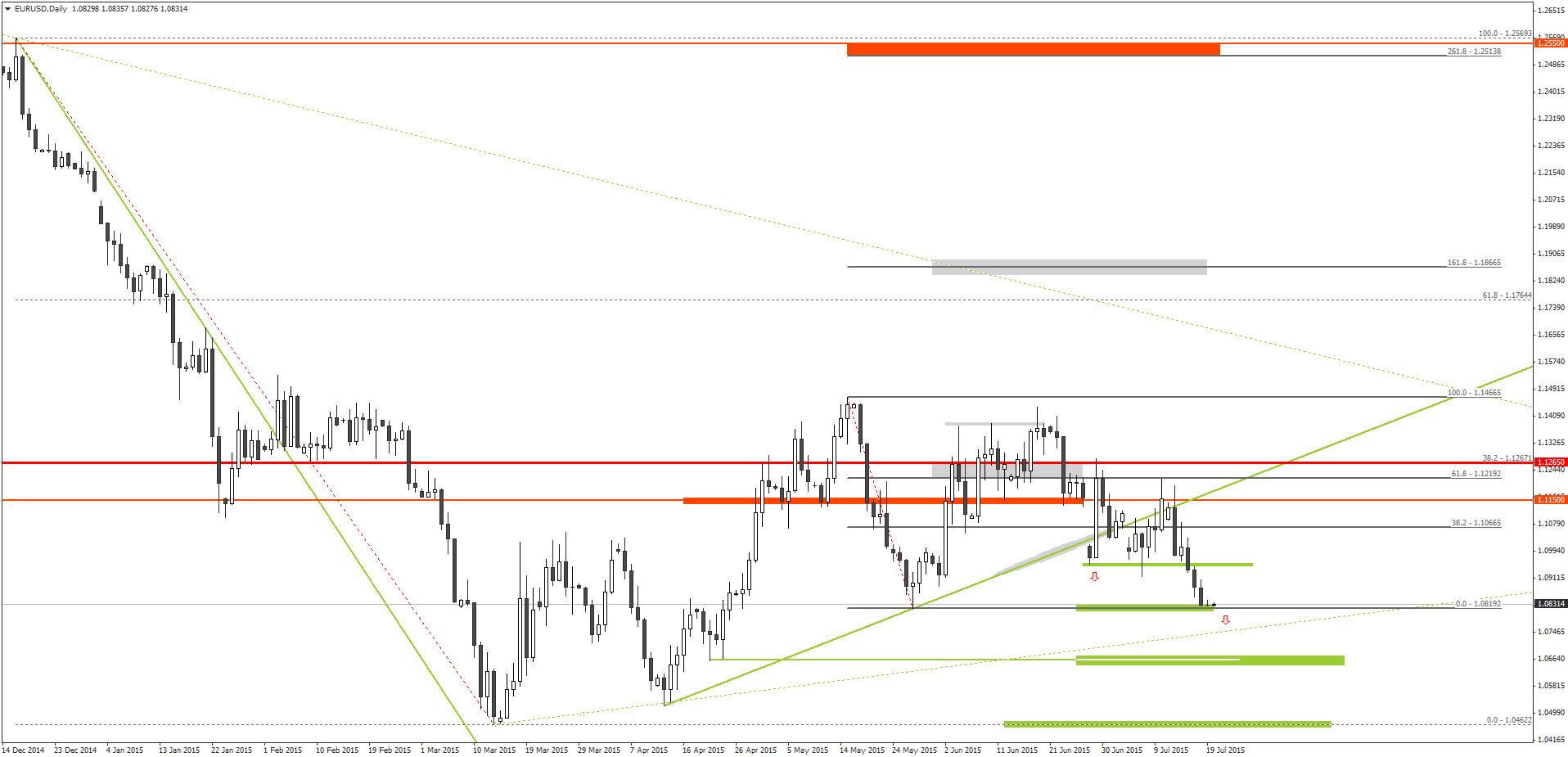

As we recommended on July 6, the EUR/USD continued its bearish movement once the price closed below the support zone, around the 1.0950 level.

Prior to this, the EUR/USD did penetrate the 1.0950 level on July 7, but the daily candlestick failed to close below this level. In fact, the retracement gained ample bullish traction to form a pin bar on July 7, which pushed the price further up, towards the 1.1219 level over the next few days.

However, the price soon found a strong resistance at exactly 1.1219, which happens to be the 61.8% Fibonacci retracement level of the last downward swing. The resistance around 1.1219 not only paused any further bullish move, the EUR/USD price actually resumed the downtrend soon after reaching this level.

Finally, on July 15, the EUR/USD closed below the important psychological support level around 1.0950, and for the last several days, it continued the downtrend.

During the weekend, there were some new developments regarding the Greece bailout issue. The German Chancellor Angela Merkel mentioned to press that there are options for limited debt relief, which is contrary to the German stance over the bailout issue for last several months.

Binary options traders took this contradictory remark by the German Chancellor as a weakness of the Euro, and the fundamental outlook for the EUR/USD once again turned bearish during the early Asian trading session.

The EUR/USD is currently trading near the support around 1.0820.

Under the circumstances, it is recommended that traders wait for the EUR/USD price to close below the 1.0820 level before placing any additional PUT orders with their binary options brokers.

Recommended Binary Options Brokers

[bonustable_fixed site1=’8′ site2=’333′ site3=’120′ site4=’189′ ]

Tagged with: EUR/USD • Free Signal