EURUSD Forecast

Contents

Introduction

The Singapore brokers will be interested in the IMF meeting as both the ECB President Christine Lagarde and the Fed Chairperson Jerome Powell will be partaking.

The European stimulus plan is stuck in the courtroom, and there is a likelihood of extending the lockdowns. Simultaneously, the US stimulus plan has been a success, and the vaccine distribution also.

EURO and US News

The French Final Services PMI

Every month of the year, data are released base on the outcome of information gotten from the surveyed purchasing managers in the service industries. A report that shows a reading above 50.0 indicates expansion while a lower reading means contraction for that month.

The survey was carried out among 400 purchasing managers’ given their perception of business conditions, employment, supply deliveries, new orders, and price. An outcome more excellent than the forecast is good for the currency, while a lower result will mean contraction and will make the euro weaken.

The forecast is for 47.8 while the previous was 47.8

The US Core PPI mm

This core PPI looks out for the changes in the price of services and goods producers are selling to consumers, excluding foods and energy, which are about 40% of the overall PPI, which intends to silence the core data’s importance.

The forecast is 0.2% while the previous was 0.2%. An actual result more significant than the forecast is good for the US dollar, while a lower outcome will mean bearish for the currency.

Some analyses believe that the outcome of the FOMC’s previous meeting had a dovish tune that led the bond market unprotected at the long end. However, the DXY is getting higher towards the 94.00 levels, which indicates that the US dollar is strong.

This week we expect the FOMC Chairperson Jerome Power to join the IMFF spring meetings during the week.

EURUSD Technical Analysis

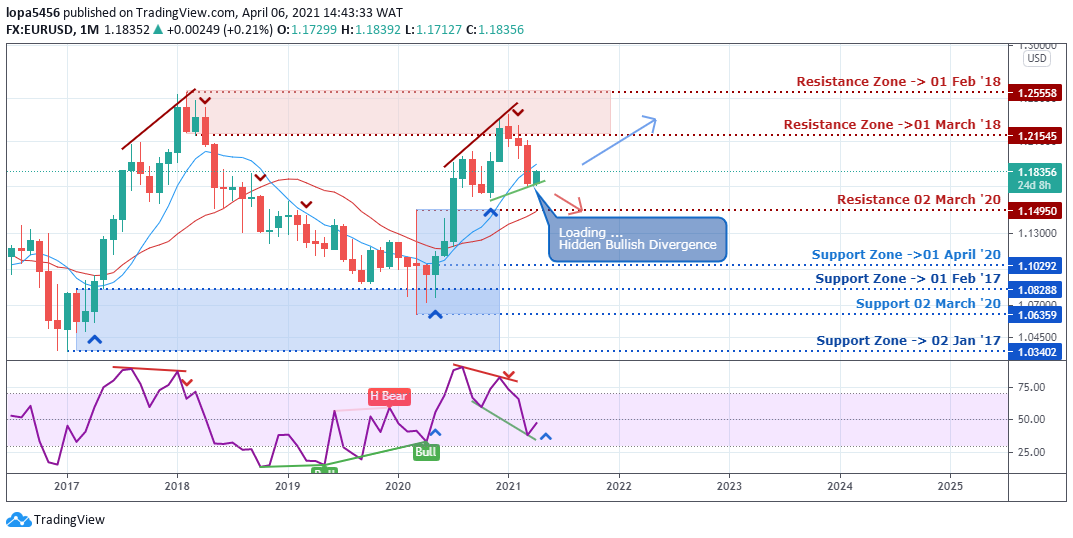

Monthly Chart Objective: Bullish and slowing

Monthly Resistance levels 1.2559, 1.21544

Monthly Support levels 1.14951, 1.10291

The previous month closed with a solid bearish candle indicating a bearish dominance within the zone.

The European zones face another wave of covid19 among the G10 countries; the vaccine’s poor distribution is not encouraging the process of recovery within the zone as more people are getting infected regularly.

The recent bullish surge is a correction phase as we expect the EURUSD pair to retest the 1.21544 zones for either a rejection or a break out above the resistance of 2018.

If the price rises above the resistance levels, we say the bullish trend continues, but if it cannot close above it, we may see the bears pushing the price to close below the 1.14951 level for a bearish trend.

Weekly Chart Bullish

Weekly Resistance levels 1.23495, 1.22430

Weekly Support levels 1.17041

The new week has started on a bullish run from a previous support region in line with the oscillator indicator in an oversold zone for an uptrend. The Bulls had previously taken control of the market as of September 2020 for an uptrend; they will likely take charge of the area this week as we await the IMF meeting outcome.

The US economy is expected to get better as the Q2 ticks off, while the dollar will be getting stronger as they continue with the next phase of the fiscal stimulus plan amid the covid-19 second wave with a successful vaccine program in this Q2 of 2021. We expect the bullish run to be a minor pullback before the Bears breaks and close below the 1.17041 levels.

Daily Chart Projections: Bullish

Daily Resistance levels 1.21897, 1.23497

Daily Support levels 1.17616, 1.19524

The EURUSD pair had been on a downtrend before it found new support on March 25, 2021. We expect the uptrend to retest the 1.21897 regions as buyers push the price for a close above the 1.19524 resistance level.

Therefore, if the bulls cannot close above the zones, we shall see bullish candles’ rejection in days to come.

Conclusion and Weekly Price Objectives

The dollar and Treasury yields have risen this year after a prolonged hit by the covid19 crisis, as investors speculate on the US overcoming the pandemic quicker than other developed countries, following significant stimulus and proactive vaccination of adults.

The biggest gain for the US dollar is 2.5% in March since the pandemic started in 2020.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: EUR/USD