EURUSD Forecast – Singapore Brokers

Contents

Introduction

Online brokers, traders and investors will be at the sidelines of the market this week as we wait for the European Central Bank and others regarding their decisions on the interest rates, likewise, the U.S Inflation data is another key factor for market participants in knowing the direction of the EURUSD pair.

The new week will face low volatility in the financial market before Thursday’s event.

EURO and US News

The Unemployment Claims

The previous data of unemployment claims was 385K while the Forecast is 370K. They based this data on the number of individuals who filed for unemployment claim insurance policy for the first time in a new week.

Some analysts say that the report is a lagging indicator, however, there is a correlation of the report with labour-market conditions because of consumer spending.

The policymakers steering the country’s monetary policy considers the unemployment rate within the country.

If the initial claims report is higher than the forecast, it is not good for the currency of the US, but a lower outcome below the forecast is good for the US dollar.

European News

Zentrum fur Europaische Wirtshaftsforschung ( ZEW)

This is a level of diffusion based on a survey carried out on German Institutional investors and analysts. They carried it out among 300 respondents who rated the economic conditions of the nation and their view in the next 6 months base on their terms. The report is released monthly, second Tuesday of every month.

If the data is above 0.0 it shows optimism while data below 0.0 shows pessimism. Therefore, data that is greater than the forecast is good for the currency while data lower than the forecast will mean bearish for the Euro. The Forecast is 86.0 while the Previous data was 84.4.

EURUSD Technical Analysis

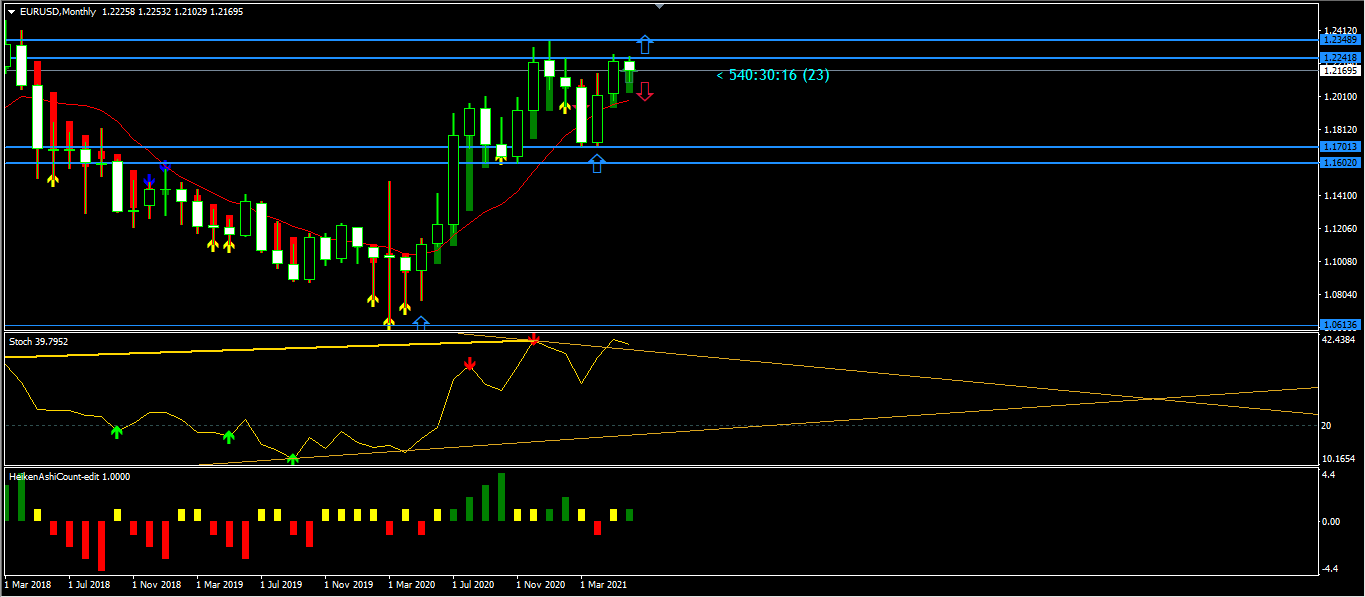

Monthly Chart Direction: Uptrend Resumes

Monthly Resistance 1.25558, 1.216689

Monthly Support 1.10390, 1.06358

The EURUSD pair is within the order block of the resistance zones of 1.216689 and 1.25558 of 2018 that took the price down. Can the zone reject the Bulls advancement or it will break out above the zone? If the bulls have stronger momentum, we may see the Bulls push pass the levels of resistance.

However, if the zone remains strong, we may see the Bears win and push down the price for a downtrend towards the lows of 1.10390 and 1.06358. If we get a stronger momentum, the price may drop to the 1.03522 level.

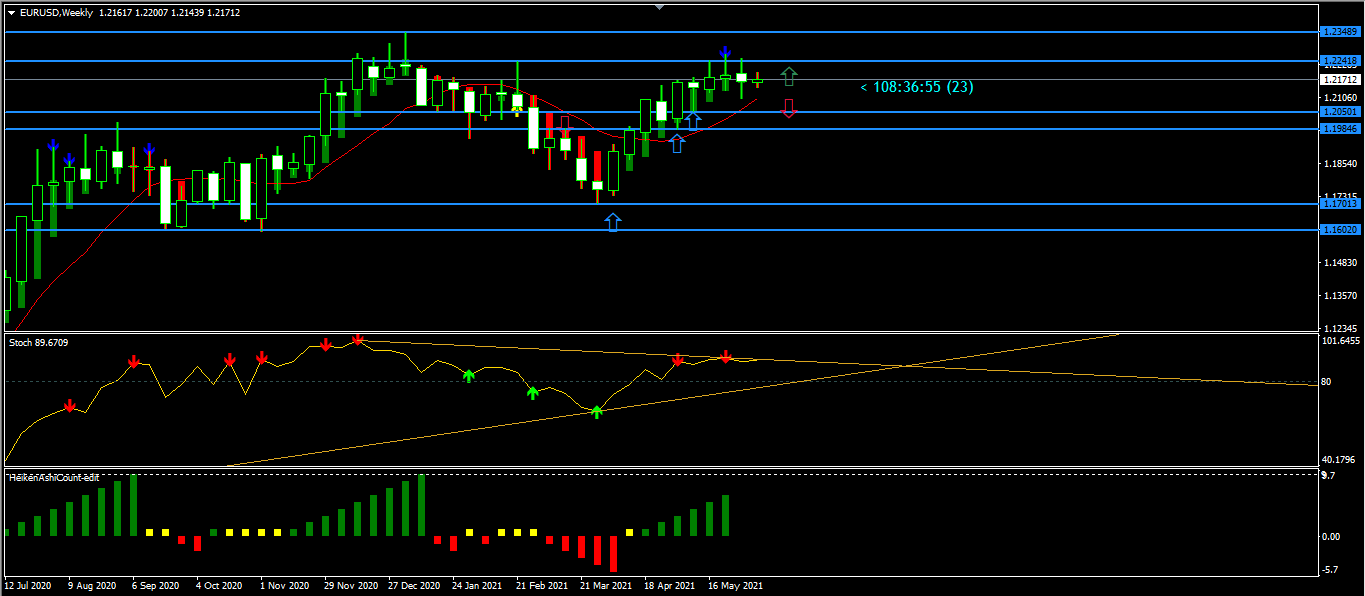

Weekly Chart Uptrend

Weekly Resistance 1.25000, 1.21663

Weekly Support 1.16875, 1.08965

The previous week ended with disappointing job data from the U.S economic calendar because online brokers and investors had high expectations towards the event.

As the new week unfolds, we expect the European Central Bank to say their plans concerning monetary policy and the interest rate which will influence the decision of investors and other market participants.

The trading activities in the financial market had been closing with indecision candles for some weeks because traders, online brokers and investors cannot decide the direction of the market.

A favourable response from the European Central Bank will lead to the rising of the pair for a close above the 1.25000 resistance levels. If the outcome will not favor the Euro, we shall see the EURUSD pair go south for a downtrend.

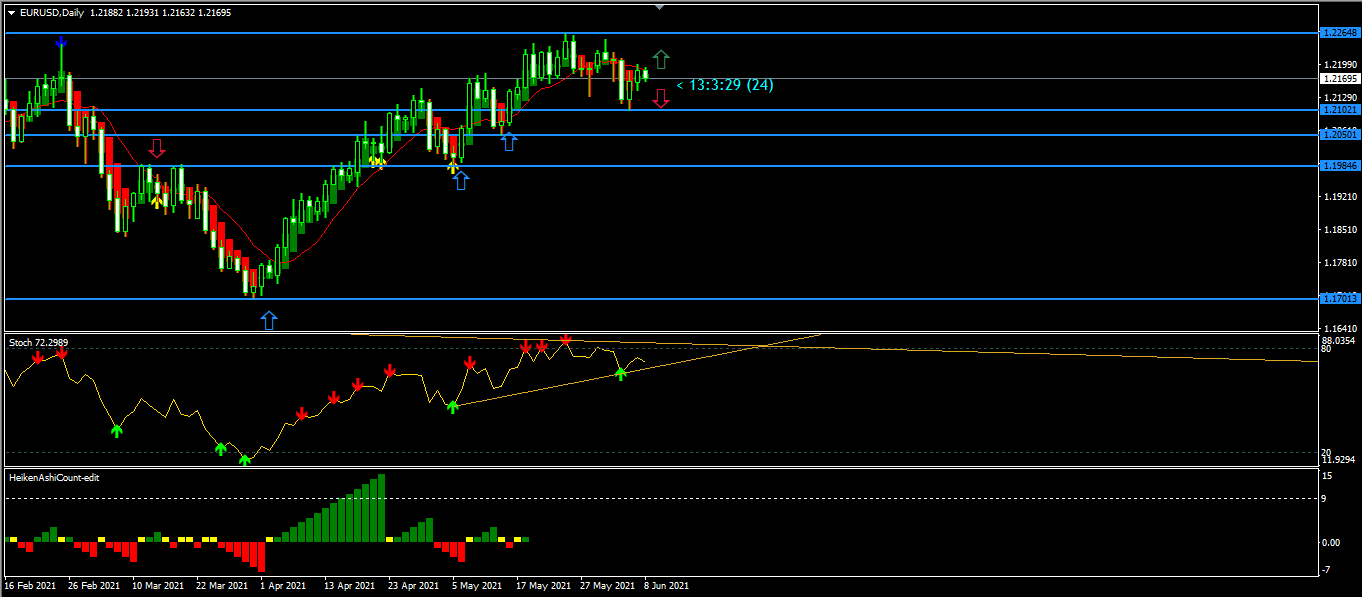

Daily Chart Projections: Uptrend

Daily Resistances 1.23496, 1.22431

Daily Supports 1.19756, 1.17042

The trading week is full of strong fundamentals that will largely influence the direction of the EURUSD as all the major currencies are doing their best to recover from the effects of the COVID-19 pandemic that has crippled economic activities around the globe market.

The inflation data is another indicator investors will pay attention to because it will influence their decision towards investment.

If the outcome is favourable to the US economy we shall see the Bears push the price down towards the 1.19756 levels of support, while an unfavourable outcome will cause the pair to rise against the US dollar.

Conclusion and Weekly Price Objectives

Some analyst believes the Federal Reserve will keep the interest rates low while they will keep the stimulus package flowing for a while. The Feds intend to open the window of the purchasing of its assets, they will begin the gradual selling of its portfolio which is about $14 billion of corporate debt purchased during the COVID-19 pandemic.

This program will attract attention in the financial markets in months to come. Most market participants will wait until they find a clearer direction.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021