The last Friday, the EUR/AUD formed a massive bullish daily bar as the price climbed as much as 270 pips during the day. The bullish move was inspired by the potential of another Eurozone bailout deal with Greece.

As the Eurozone leaders came in agreement with the Greek Government about the terms of the third ballot, the global binary options market is set to become further bullish regarding the valuation of the Euro against other major currencies. Commenting on the new bailout deal, the European Commission Head Jean-Claude Juncker told the BBC that “There will not be a ‘Grexit.’”

Later, several other European state parliaments ratified the deal with the Greek Government, making it official that at least for now, Greece will continue to use the Euro as its national currency.

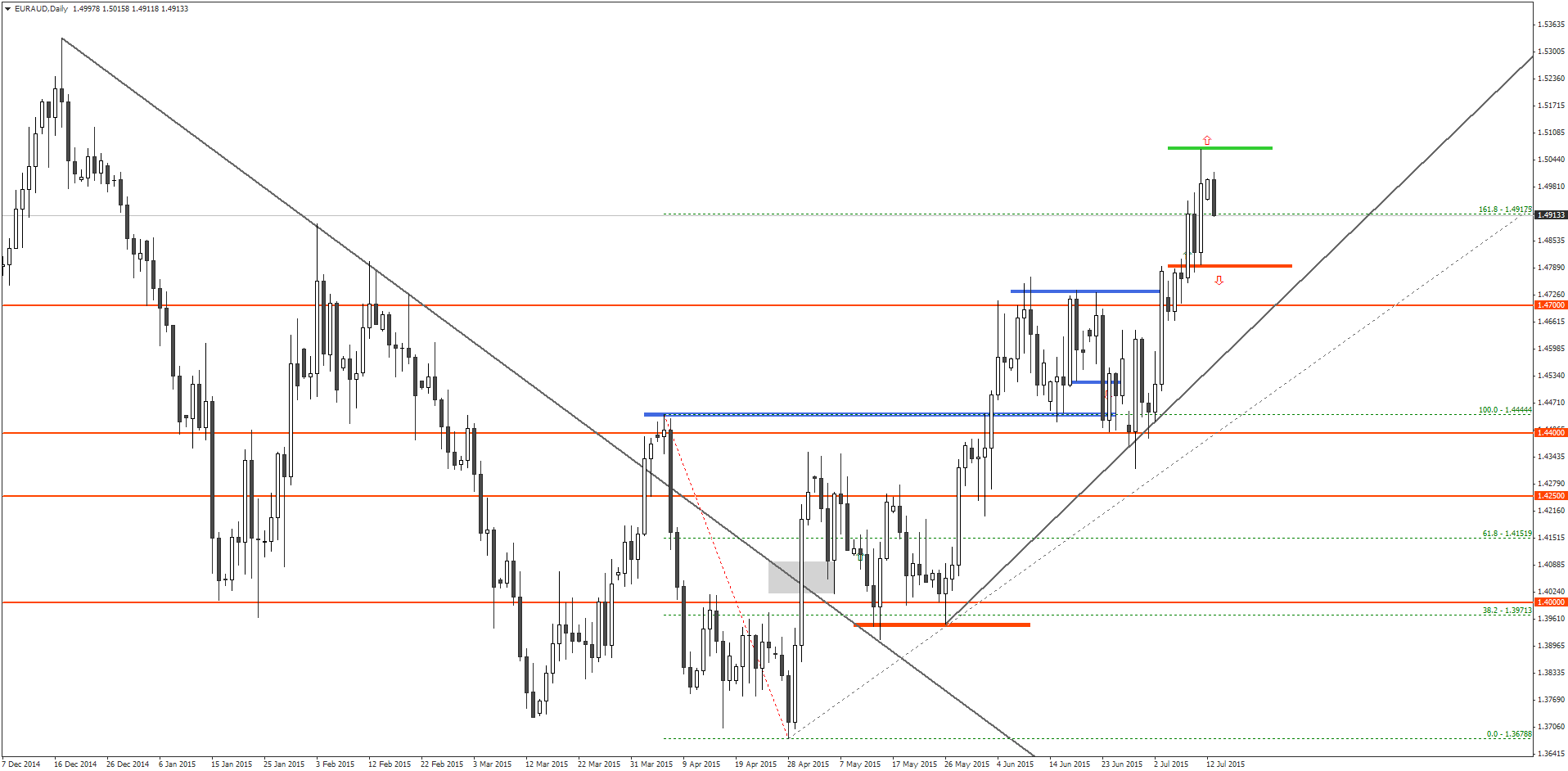

If we count the Sunday candle, the EUR/AUD has effectively formed an Inside Bar with the Friday’s daily bar. As the market fundamental turn positive for the Euro, the likelihood of additional bullishness in the market is high.

The EUR/AUD has been trading with a bearish note, since the market opened today and the price declined around 105 pips. However, it would be seen as a retracement by the binary options investors.

Nevertheless, if the EUR/AUD price goes below Friday’s low, the technical prospects will rapidly change and there might be additional selling.

Hence, it is recommended that traders place a CALL order once the price closes above 1.5070 or a PUT order once the price closes below 1.4798 for the EUR/AUD with their binary options brokers, as the outlook for this pair would change depending on which way the Inside Bar breaks.

Recommended Brokers

[bonustable_fixed site1=’219′ site2=’333′ site3=’120′ site4=’189′ ]

Tagged with: EUR/AUD • Free Signal