Bitc0in Price Forecast

Contents

Introduction

The rate at which the market recovered from the previous dip has amazed the online brokers such as IQ Option.

Many have shifted their bias to an uptrend as the market participants are also reacting to the recent news concerning the US dollar that may hit a debt ceiling and will probably put the currency into an economic recession.

Investors now see bitcoin repeating its position as a safe-haven asset like it did during the pandemic.

BTCUSD Technical Analysis

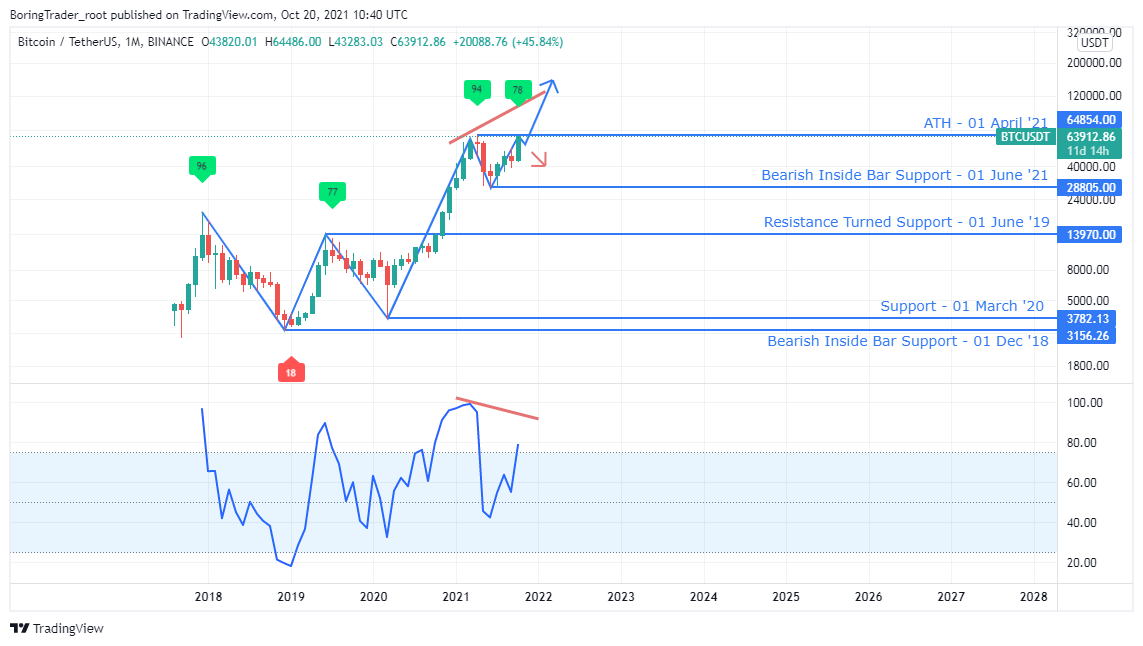

Monthly Chart Bullish,

Monthly Resistance Levels: 65000, 53000

Monthly Support Levels: 28673, 39000, 53000

The month of October has continued to experience bullish momentum in recent days, as the ATH is likely to be taken out before the month comes to a close. An explosion is about to happen on the BTCUSD pair as we see the Bullish trend is soaring higher. The price is around the 61350 dollar mark as of the writing of the report and the ATH is the area of interest for the online brokers.

Some traders believe that since the price is testing the zone after a long time and we may see another rejection of price around the 65000 zones for a pullback towards the 53000 level.

Weekly Chart

Weekly Resistance Levels: 65500, 53000

Weekly Support Levels: 40000, 28280

The BTCUSD pair was able to recover quickly after the sharp drop of price from the previous resistance level of 53000 sent the price down to the support level of 40000 area. Recently, events around the globe have also boosted the strength of the coin with an increase in acceptance and adoption of bitcoin.

A Brazilian bank, BTG Pactual launched a crypto trading app in South America as the first bank to give direct exposure of bitcoin trading to its clients in Brazil and also the first investment bank to launch bitcoin and crypto funds to its customers.

Daily Chart

Daily Resistance 65100, 50000

Daily Support 46540, 40500.

Technically, the support level on the daily chart, the candlestick reversal pattern, took the price up from the support levels of 40500.

News favoring the bitcoin holders sustained the momentum as more investors see it as a safe-haven amid the uncertainty facing the economy of the world.

Feeds from PSV, a Dutch football club, had a sponsorship deal with an exchange. Anyone will pay the team in bitcoin. In another fashion, the UAE government will exempt tax from bitcoin trading within some economic zones in its capital Dubai. All these and more are factors that favor the bullish run.

H4 Chart

4 Hour Resistance 65000.00

4Hour Support 58963.00, 57839.04, 53879.00, and 50382.41

The strong rejection of the seller’s moves around the 50930 zone took the price of bitcoin higher after breaking out of the accumulation stage (57640). The breakout leads to another higher high of bitcoin price.

The bears’ attempts have been rejected severally by the buying pressures of the bulls anytime they try to short the market. The market is consolidating at the writing of the report. Bitcoin price will decide on the next direction as retail traders take their profit for safety.

Bullish Scenario:

A close above the daily resistance level of 65000 will give the online brokers on buying strips some advantage to push the price of bitcoin higher for a newer ATH.

Bearish Scenario

The bears will observe price reactions around the psychological level of ATH zones for either a close or rejection. If the rejection holds, we shall see a fall in bitcoin price.

Bitcoin BTC News Events

CEO of Morgan Stanley says Crypto is here to stay

The Chief executive officer of global investment bank Morgan Stanley says that bitcoin and other cryptocurrencies are not a fad and they are going away during the bank’s third-quarter earnings meeting. Due to the demands from banks’ clients, they opened up a dedicated research team on digital assets.

The bank was among the first to embrace bitcoin and add it to the bank’s mutual funds’ investment strategies. It states that cryptocurrency is not a big part of the bank’s business, but could develop with it as the business grows. The bank does not trade crypto directly for retail clients but gives access to them to buy bitcoin or other cryptos through various funds.

BTCUSD Conclusion and Projection

As a result of institutional interest rises, we can see the effect on the BTC pair as the bullish momentum gets stronger by pushing the price up towards the All-Time-High of the bitcoin chart.

If the bullish run can close above the resistance of level of 64000, the price of bitcoin will establish a newer high in the history of the digital asset.

However, if the BTC price cannot close above the high convincingly, we may see the bears take advantage of the short opportunity. The price may fall to the 60000 levels.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: btcusd