Bitc0in Price Forecast for Bitcoin

Contents

BTCUSD Introduction

The Wall Street involvement in the cryptocurrency hedge funds is attaching the likes of JPMorgan and UBS as they carry out their due diligence. This is interesting news for OlympTrade investors as they see the wall street giants get deeper into the cryptocurrency industry. Wells Fargo announced a plan that would attract major banks who will follow as the firm introduces an active strategy for deep-pocketed cryptocurrency clients.

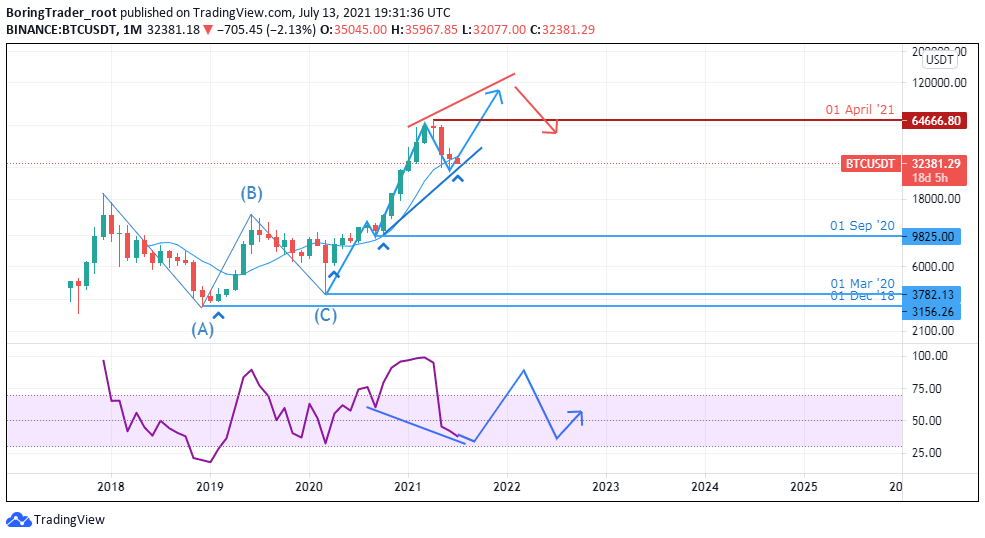

BTCUSD Technical Analysis

Monthly Chart

Monthly Resistance Levels: 41450, 50000

Monthly Support Levels: 28798, 30,000

The biggest Swiss bank UBS has offered its big and affluent clients an opportunity to explore digital assets. The regulatory clampdown has shown that the price of bitcoin is still bearish. If the price should close lower than the 28798 zones, we shall see another push creating a new low. However, if the zone can hold the price, you may see the bulls take over the market from the zone.

Weekly Chart

Weekly Resistance Levels: 41500,36680

Weekly Support Levels: 28800, 30000

The BTCUSD price has been trapped between the resistance zones of 36680 and the support levels of 30000 for some weeks. Online brokers have to be careful now because the market does not have a definite direction as of now. The trading volume on bitcoin has decreased, and it is the reason the market has been in a range for a while.

Some analysis also believes that bitcoin price may drop lower because of low liquidity in the market. JPMorgan feels institutions are not buying the BTC slump until it plunges to the low of $22500 before the next rally. Institutional Investors and online brokers are still exhibiting an appetite to buy bitcoin dip through a regulated platform like CME bitcoin futures or publicly listed bitcoin funds.

Daily Chart

Daily Resistance 41499,36680

Daily Support 30000, 28798

The support zone of 28798 of 22 June 2021 is the lowest low since the price of BTC fell from its ATH on the daily chart. The zone has been rejecting the bear’s advancements and the price has not gone past the 30000 levels for weeks. The bears are still in control of the market, however, but the momentum is weak presently. If they need to continue the bearish trend, they need to close below the 30000 and 28798 levels.

Should the Bulls find a stronger reason for a buy bias we expect the support level to be a springboard for the bull’s rally as buyers take control of the zone to close above the 36680 levels.

H4 Chart

4 Hour Resistance 35000

4Hour Support 31590, 32000, 28800

From the 4-hour chart, we can see that the market has been creating higher high higher lows also lower highs lower lows within the high of 35000 and the support level of 28800. The issue of regulation will probably delay the resumption of the Bulls for a while until various countries have come up with acceptable regulatory demands for the users

Bullish Scenario:

Long position online brokers have to wait longer for the market sentiment to change as the coin pass through regulatory clampdown happening in the industry. A close above 36679 levels on the daily chart will probably turn the trend into a bullish run.

Bearish Scenario:

The weekly time frame is bearish as BTCUSD traders are still in a short position, a close below the support zone of 28798 will mean another fall in the price of bitcoin.

Bitcoin BTC News Events

Nuclear Deals for Bitcoin Miners

In the USA, a company based in California is developing clean energy plants has announced its new deal with another U.S based company that will last for 20 years. The company is Compass Mining, an online marketplace for BTC-Bitcoin hosting and mining hardware.

In keeping up with the clean environment policy’s they are introducing advancements in nuclear fission to compensate for fossil fuels which will improve diversity and sustain the energy used by miners.

Energy Harbor is an independent power producer announced a partnership deal with a mining company hosting provider Standard Power that will last for five years. The company Energy Harbor will provide electricity from its nuclear power station and power the new bitcoin mining center of Standard Power firm.

BIT Mining Limited, a mining company entered into an agreement with an undisclosed institution and accredited investors by raising about $50 million through private placement as it entered into a securities purchase agreement. The BIT mining company intends to acquire more mining machines as they plan to build new data centers abroad, expand its infrastructural facilities, and upgrade its working capital position through the net proceeds generated.

Foundry Digital, a crypto mining and staking company sold about 2300 Whatsminer M30S mining machines to Greenidge. Greenidge is in Upstate New York, a mining power generating firm that uses a carbon-neutral bitcoin mining facility. The machines were previously used in the company by Found digital.

BTC Price: Conclusion and Projection

As the Chinese authorities are bent on closing down all crypto mining projects within its provinces because of power shortage, we can see that all crypto mining projects shall be closed in Anhui province in the next three years and new projects requiring a larger amount of energy shall be curbed. However, new sites are coming up around the world are more mining activities are opening up.

Online brokers have to be patient as the market’s sentiment is still uncertain and the bitcoin price is still in consolidation on the BTCUSD weekly time frame. We shall be waiting for the market to breakout either to the upside or downside.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: btcusd