Australia – National Australia Bank (NAB) Limited Business Confidence Index

Contents

Today, at GMT 1:30 a.m., the National Australia Bank (NAB) Limited released its monthly business confidence index figure. This figure measures the level of a diffusion index based on a survey of 350 businesses in Australia.

The survey asks respondents to rate the current business environment in Australia. Since businesses are the first to react to changing business conditions, the level of their sentiment regarding optimism and business confidence, binary options investors consider it as a leading indicator of the overall economic health in the coming months.

Last month, in July, the NAB business confidence index came out at 8, where any figure above 0 indicates improving conditions. This month, however, the NAB business confidence figure came out much lower, at 4.

Switzerland – Producer Price Index (PPI)

Later in the week, on Thursday, at GMT 7:15 a.m., the Swiss Federal Statistical Office will be releasing the month-over-month Producer Price Index (PPI), which measures the changes in the price of goods and raw materials bought by Swiss manufacturers during the previous month.

Binary options traders consider the Swiss Producer Price Index (PPI) to be a leading indicator of the consumer inflation because any substantial increase in the raw materials is passed on to the buyers of the finished products by manufacturers. Hence, an increase in PPI indicates rising prices at the consumer level, which contributes to overall national inflation.

Last month, the Swiss PPI (m/m) decreased by 0.1% and the forecast for August is currently set at another decrease of 0.2%.

Trade Recommendation for the AUD/CHF

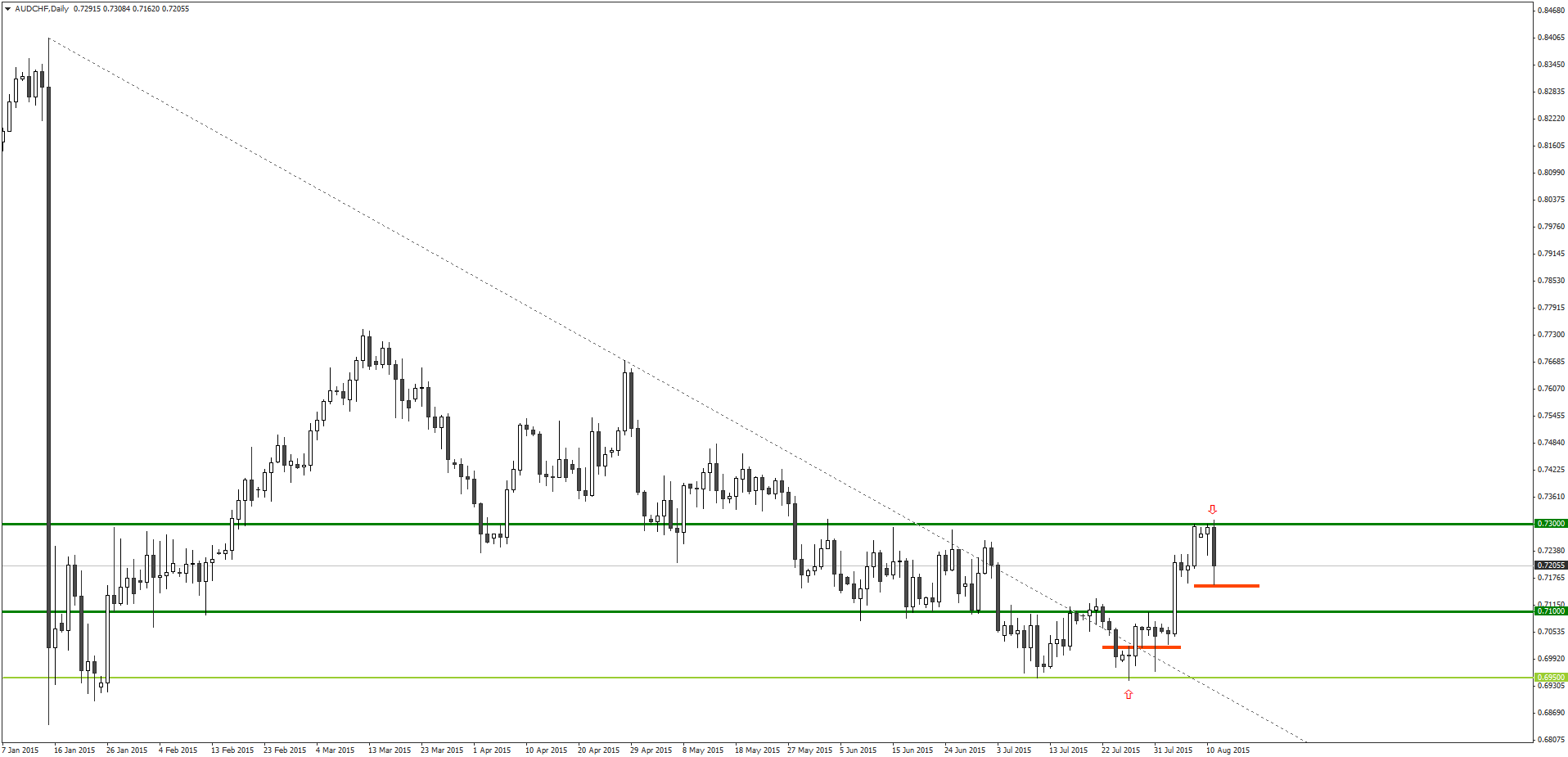

Since forming a bullish pin bar around the support level near 0.6950 on July 27, the AUD/CHF price has climbed up around 280 pips.

Last week, the AUD/CHF price reached near the psychological resistance zone around the 0.7300 level, but after several attempts by the bulls, it has so far failed to close above this level.

Earlier today, the AUD/CHF price once again was rejected around the 0.7300 level, amid the release of the NAB business confidence index, which declined to 4 this month against 8 from last month.

As today’s daily price has so far engulfed last three daily bars, it would effectively form a bearish outside bar (BEOB), if the price closes below 0.7291. The formation of a BEOB around this important resistance zone around 0.7300 would signal additional bearish momentum in the AUD/CHF for the next few days.

Under the circumstances, it is recommended that traders consider placing a PUT order for the AUD/CHF with their top binary options brokers, once the price penetrates below the low of August 11, which is currently at 0.7162.

Recommended Binary Options Brokers

| Broker | Max.Bonus | Min.Deposit | Rating | Good Points | Max.Payout | USA | Regulation | |

|---|---|---|---|---|---|---|---|---|

| Free $10,000 Demo Account | $10 | 5.0 | Top Regulated Broker $10 Min.Deposit Free Demo Acc. #1 Crypto app | 98% | Not | - | VISIT IQOPTION IQOption Review |

| Free $10,000 Demo Account | $10 | 4.8 | Best Platform $10 Min.Deposit Free Demo Acc. Quick Withdrawals | 90% | Not | International Financial Commission | VISIT OLYMP TRADE Olymp Trade Review |

Tagged with: GBP/CAD • Trade of the Week