Fundamentals

Contents

Since the beginning of the new year, AUDUSD has enjoyed a nice advance rising from the support zone at 0.7160 up to 0.7566, as of today.

The rise in the AUDUSD exchange rate is not only the result of the pause in the US Dollar bull trend but also positive developments for the Australian Dollar and a broad strengthening of the AUD recently. Notably since the start of the year, gold and iron ore prices are up. The People’s Bank of China set the trading range of the Yuan higher in the beginning of the year and has set in a rally in the currency since then. The Yuan and the Australian Dollar usually move in the same direction.

This week is full of important events that can affect where the USD and AUD trade. The most important event of the week is, of course, Mr. Trump’s inauguration on Friday, January 20th and his speech at the event.

Further, Fed chair Janet Yellen will speak twice, later today and on Friday as well as several other FOMC Presidents.

From Australia, the employment reports on Thursday will mostly affect how the Australian binary options trades.

Technicals

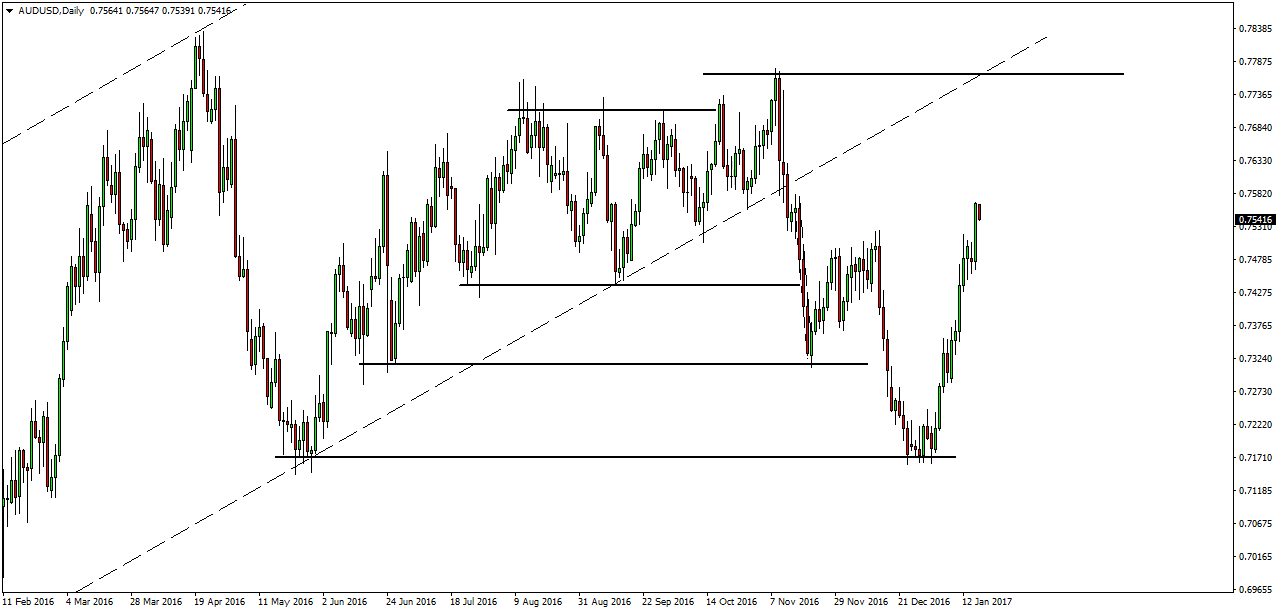

The ongoing uptrend in the pair is strong. The pair is trading close to the 61.8% Fibonacci retracement of the move down since Trump’s win on 8 November. However, the pair already closed above this level so it can be considered as broken resistance now.

Currently, there are no resistance levels to the upside as far as the highs at 0.7760. Technically this means it’s very likely that this area will be reached in the near future.

Right above this resistance zone, the lowered border of the long-term channel (dotted black line) will provide resistance (currently near 0.78)

Support is down at the recent low, 0.7160.

AUDUSD daily chart – The pair strongly reversed from support

Our Recommended Australian Binary Options Broker to trade AUDUSD:

Best Australian Broker: HighLow

Founded in 2010, HighLow is considered one of the largest binary options broker in Australia with considerable popularity among local traders who enjoy the regulatory protection from one of the strictest government authorities (ASIC).

- Fast Withdrawals

- Only £50 Minimum Trade

- Regulated Broker by ASIC-Australia

- Bonus £50 Cask-back

- Free Demo

- Up to 200% Return

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021