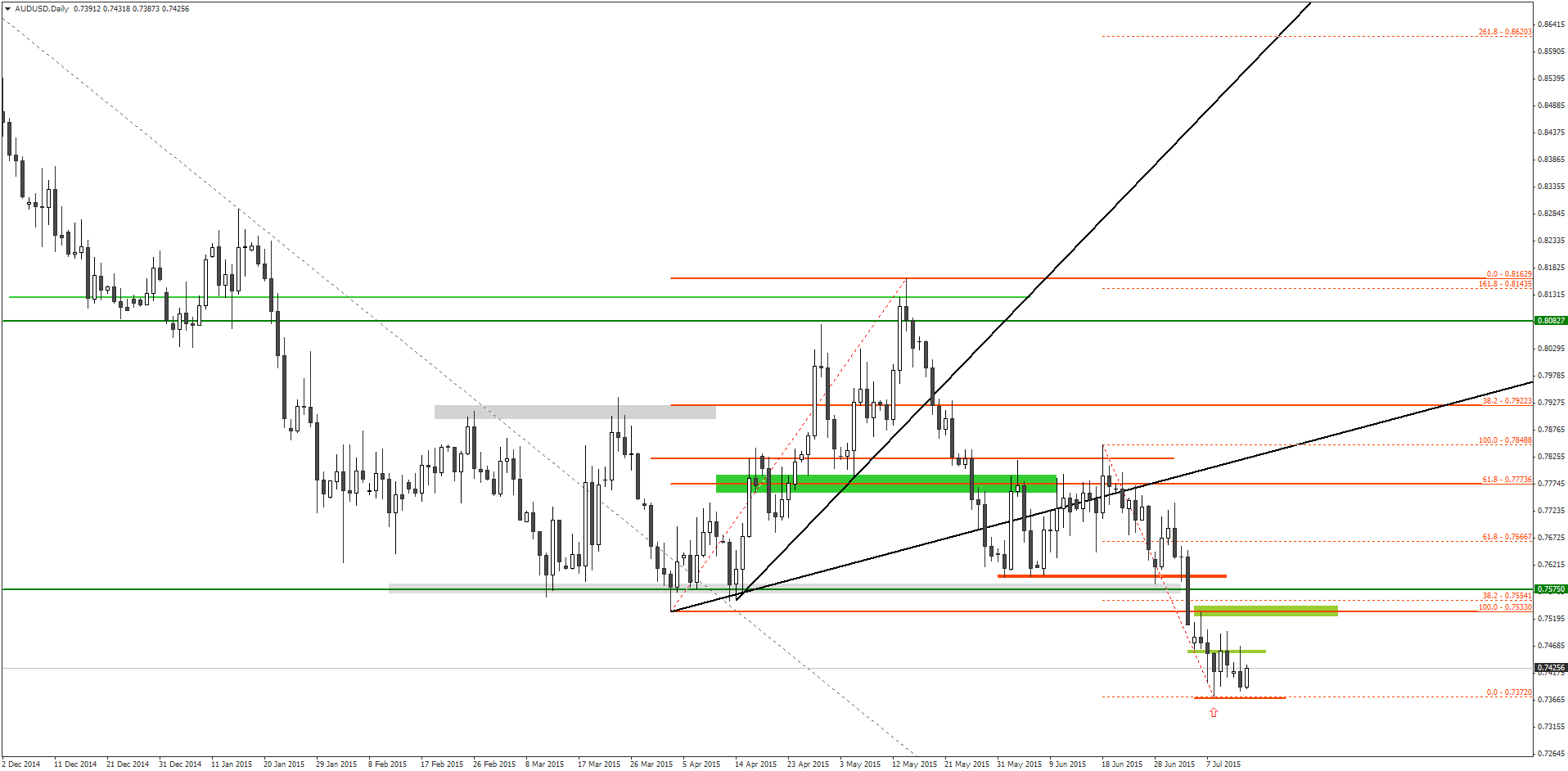

As the AUD/USD price broke below the psychological support level around 0.7575 on July 3, the pair finally started trending downwards after remaining in a range between 0.7575 and 0.8150 for the last several months.

Interestingly, right after closing below the 0.7575 support zone, the AUD/USD retraced upwards. The support turned into a strong resistance and the pair formed a bearish pin bar on July 6. The subsequent bearish momentum pushed the price much lower towards the 0.7370 level by July 8.

The price soon retraced and formed a bullish pin bar on July 8, and the high of this pin bar was penetrated on July 9. However, so far, the AUD/USD price has struggled to show any sign of additional bullishness and failed to close above the high from July 8, which is at 0.7456.

Yesterday, the Australian NAB business confidence index reading came out at 10 against last month’s 8, which encouraged the AUD/USD bulls. On the other hand, there are a handful of important US news releases are scheduled on Thursday and Friday, including core CPI and building permits figures.

Moreover, the US Federal Reserve Chair Janet Yellen is going to testify on the Semiannual Monetary Policy Report before the Senate Banking Committee, in Washington DC on Thursday afternoon.

It seems that the AUD/USD would likely to trade within a narrow range until there is any further fundamental development in the binary options market. Nevertheless, if the AUD/USD price closes above the 0.7456 level, it would certainly indicate additional bullish moves this week.

It is recommended that traders place a CALL order for the AUD/USD, once price closes above the 0.7456 level with their binary options brokers, as the outlook for this pair would turn bullish in that scenario. This bullish signal would remain valid as long as the AUD/USD price is trading above the 0.7370 level.

Recommended Brokers

[bonustable_fixed site1=’219′ site2=’333′ site3=’120′ site4=’189′ ]Tagged with: AUD/USD • Free Signal