United States – Existing Home Sales

Today, at GMT 2:00 p.m., the US National Association of Realtors will release the existing home sales number, which is the annualized number of residential buildings that were sold during the last month in the country. However, this figure excludes the number newly building constructions.

Since the sale of an existing home usually has a wide-spread positive ripple effect in the local economy, collectively this figure acts as an excellent leading indicator of the overall economic health of the country. Therefore, binary options investors consider the existing home sales number to be an important data as it tends to have a considerable market impact.

Last month, the US existing home sales figure came out at 5.59 million and the forecast for this month is set at 5.50 million.

United Kingdom – Public Sector Net Borrowing

Tomorrow, at GMT 8:30 a.m., the UK’s Office for National Statistics will release the public sector borrowing figure that measures the difference in value of the spending and income of the public corporations as well as the central government of the UK and other local governments during the last month.

A positive public sector borrowing figure would indicate a budget deficit and a negative figure would indicate a budget surplus. Hence, a negative figure is usually taken as good news for the British Pound.

Last month, the UK public sector borrowing figure came out at -$2.1 billion, and the forecast for this month is set at a much higher figure, at $8.7 billion.

Trade Recommendation for the GBP/USD

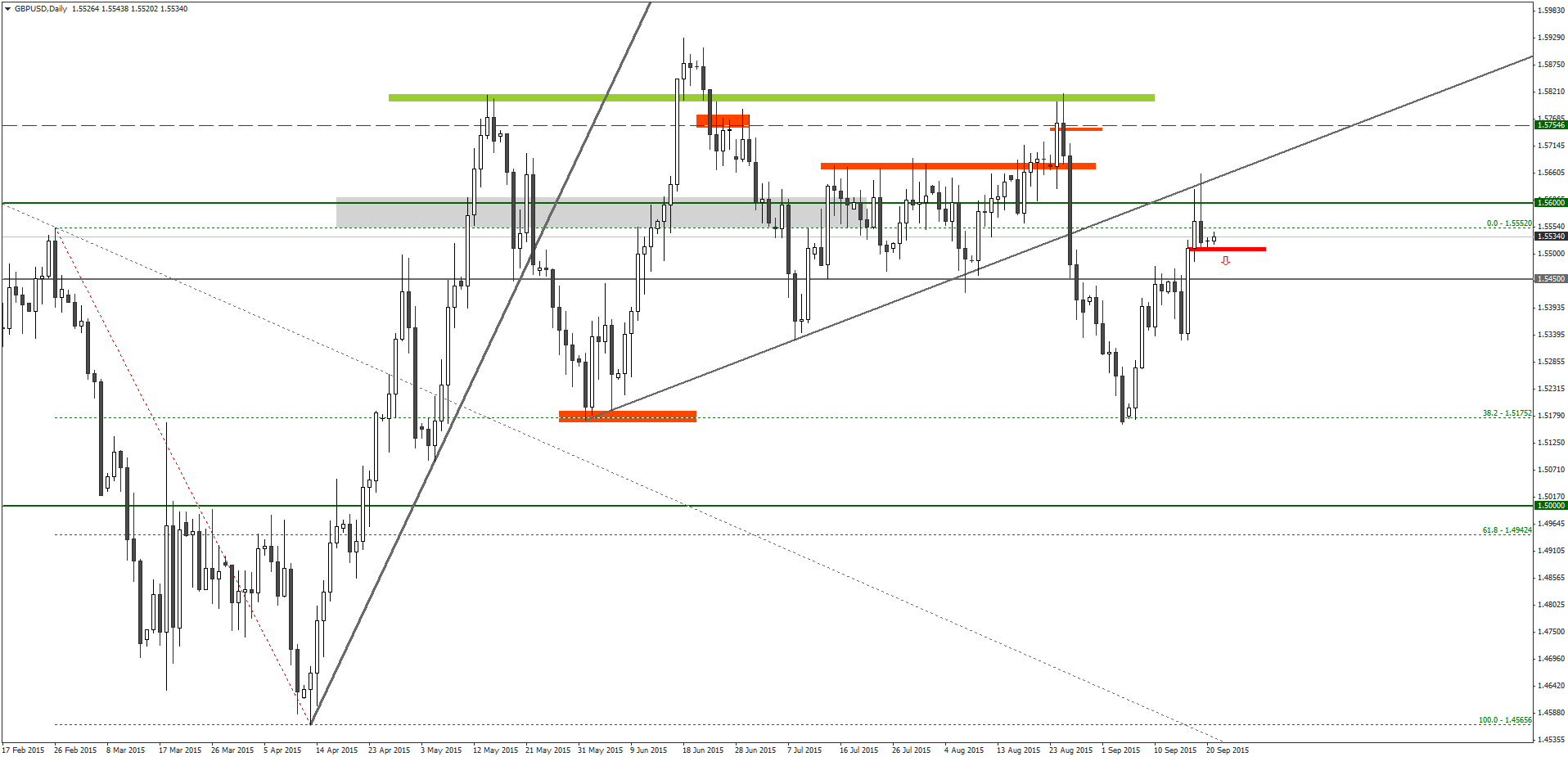

Since the GBP/USD price penetrated below the medium term uptrend line on August 26, it has been trending downwards. However, after reaching near the psychologically important support around the 1.5175 level, it reversed and started a retracement move back towards the previous uptrend line.

Last Friday, the GBP/USD touched the uptrend line and immediately the price retraced. As a result the GBP/USD formed a bearish pin bar at this important resistance zone near 1.5600.

As the UK’s public sector net borrowing figure is expected to spike up this month, the fundamental outlook would also be bearish this week.

Under the circumstances, it is recommended that traders consider placing a PUT order for the GBP/USD with their binary options brokers, once the price penetrates and closes below the low of the Friday’s bearish pin bar, which is at 1.5514.

Tagged with: GBP/USD • Trade of the Week