Anyone trading binary options for long enough knows that breakouts are the first signs that a Forex pair would start to trend. Because the prices in the Forex market remain within a tight range for most of the time, identifying a proper breakout can provide binary options traders an opportunity to make high probability trades, as during these breakouts, price gains heavy momentum.

While there are a lot of breakout strategies, today we are going to discuss one that uses standard deviation to confirm if the breakout is valid or not. By doing so, we will be able to refine our trade setup and improve the odds of our winning.

Preparing the Chart for Standard Deviation Breakout Strategy

The first thing you need to do to trade the Standard Deviation Breakout Strategy is selecting which Forex pair and what timeframe do you want to trade.

This is a secular strategy and works in all pairs and all time frames. However, you need to change the standard deviation level on each timeframe for each pair in order to make it work. It may sound complicated at first, but once we will describe how to pick the right standard deviation level, It would appear very simple.

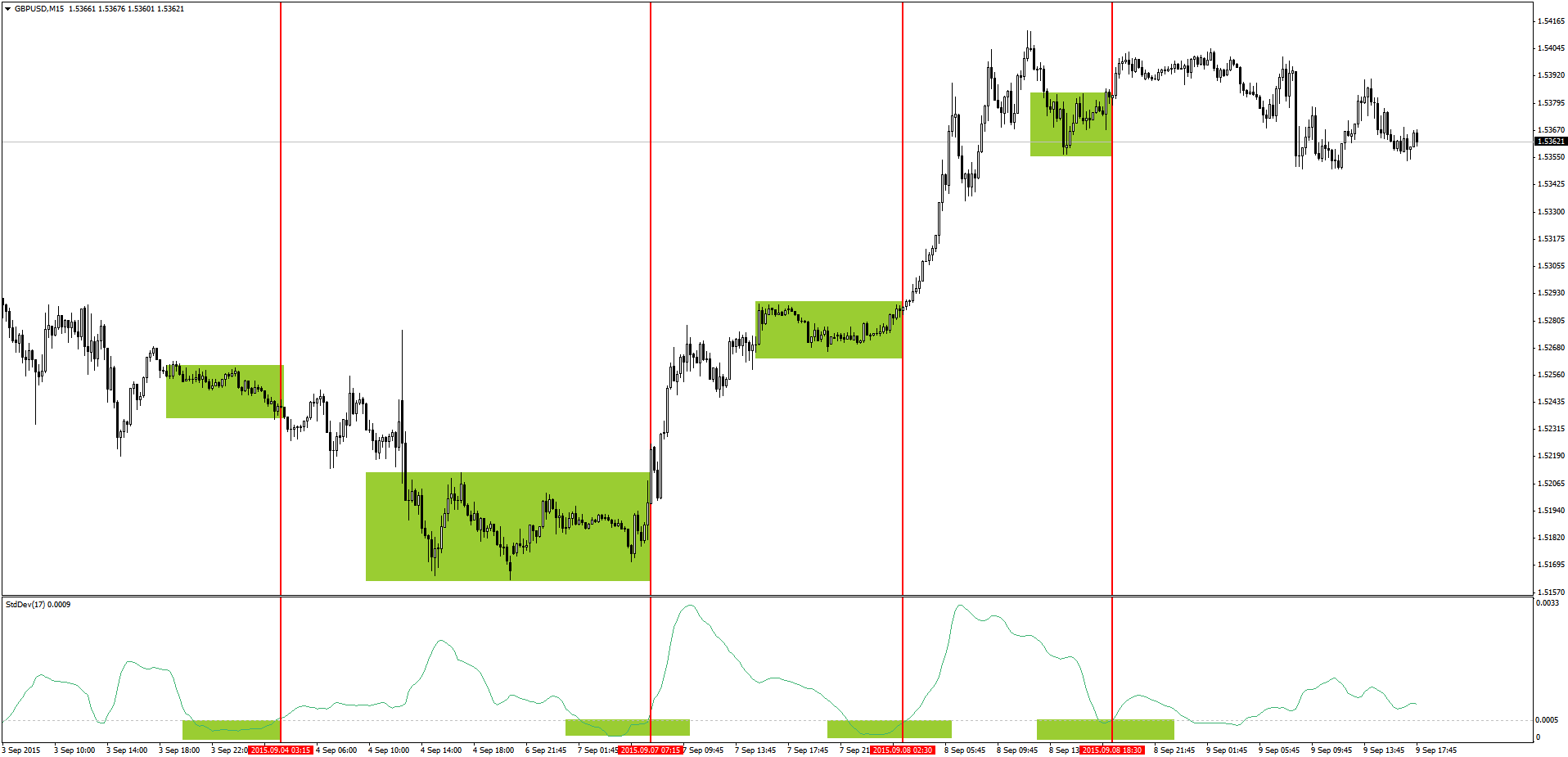

So, let’s say you want to trade the GBPUSD pair on the 15 minute chart.

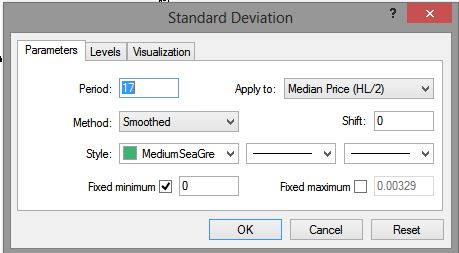

On this 15 minute chart, apply the Standard Deviation indicator on MetaTrader 4 with 17 period. Select method as Smoothed and apply to Median Price (HL/2).

Now, find a consolidation zone where price remained within a narrow range and standard deviation value was very low.

At this point, we are looking for a pattern where the Standard Deviation started to pick up after a breakout and curve fit that value in future trading. Once you find a general value of Standard Deviation that confirms a trend, add a level in the Standard Deviation indicator with that value.

For the GBPUSD pair’s 15 minute chart, we found a suitable Standard Deviation value that confirms a breakout is 0.0005.

On other pairs and timeframes, it will be different, so you need to pick the Standard Deviation value for each pair and the timeframe you are interested in order to trade successfully in this strategy.

Sample Chart

Trading the Standard Deviation Breakout Strategy

Once you have successfully identified the breakout level of the pair and timeframe, trading this breakout strategy becomes very easy indeed.

At this point, all you need to wait for the Forex pair’s Standard Deviation to go below the identified level, and wait for it to start going up again. The direction of the breakout will be confirmed by the breakout itself and we don’t need to use any other fancy indicators for that.

But, to trade this strategy successfully, once the price breakouts of a range and standard deviation goes above the identified level, you should wait for the price to come back below the high or low of the breakout range for placing CALL and PUT orders, respectively.

Meaning, if the price breakouts above the range, wait for a pullback below the high of the range and then place the CALL order. Because, the lower your strike price will be after the breakout, the higher your chance for winning the trade.

Similarly, if the price breakouts below the range, wait for a pullback above the low of the range and then place the PUT order.

Tagged with: Binary Options Strategy • breakout