USDSGD Technical Analysis for Singapore

Contents

Introduction

The Singapore broker is concerned with the state of the market as the recent sanctions on China by the EU, US, and Britain has led to the immediate riposte of the diplomats, institutes, and families of all the countries involved. This action will cause a ripple effect in the global market, likewise the foreign exchange.

Singapore Fundamentals

Report from the Singapore core consumer price shows an increase of 0.2% compared to the previous year report as at the same time, which exclude the private road transport cost and accommodation.

The monthly consumption prices rose by 0.6% as of February 2021. The annual inflation rate rose from 0.2% to 0.7% within January and February, which was above the market consensus of 0.6%.

US Fundamentals

The issue surrounding China’s maritime militia vessels in the South China Sea, threatening her neighbors, has led the US government to support the Philippines in the China-Philippine aggression in that region.

Powell to testify

The Fed’s point of view regarding interest rates was clearly stated during the FOMC meeting last week. At the same time, most market participants would want to get better details from Yellen regarding further infrastructural investment as they appear before the Senates.

USDSGD Technical Analysis

USDSGD Long term Price Analysis

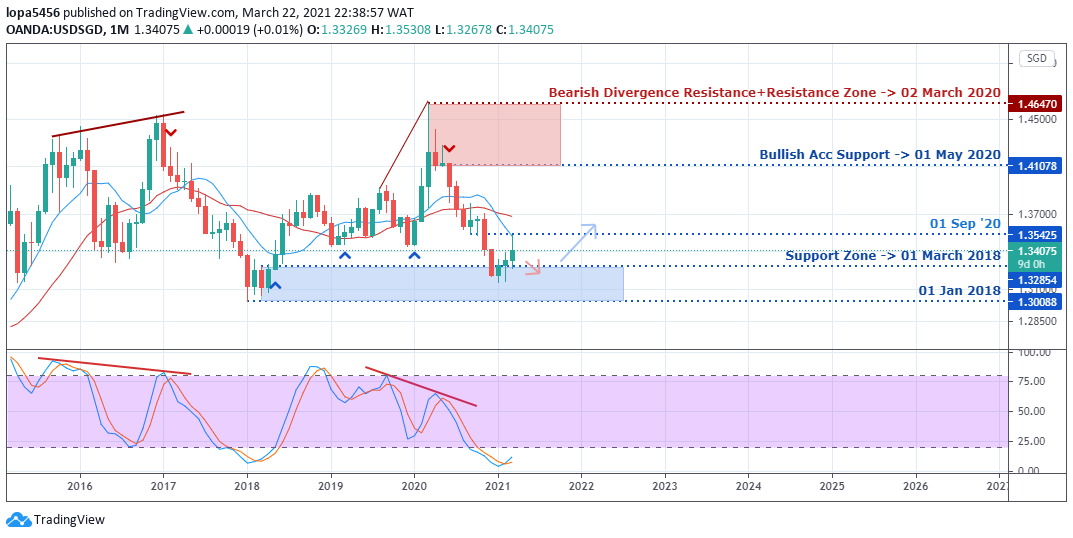

Monthly Outlook: Bearish Slowing

Monthly Resistance level 1.46470, 1.411078

Monthly Support level 1.32854, 1.34075

The previous resistance level of 2017 was tested again as of March 2020, the peak of covid-19 crisis creating a double top pattern that led the USDSGD pair to a downtrend. The Singapore foreign exchange was favorable against the weak US dollar during the pandemic.

The pair finds support at 1.34075 zones since the beginning of the year 2021. If the support zone can hold and the bulls can break above 1.35425 resistance levels, we may see the US dollar gains against the Singapore dollar to reach the 1.41078 zones.

If the Bulls really should fail, we may see the Bears close below the 1.34075 zones for another bearish rally.

Weekly

Weekly Resistance Levels: 1.33892, 1.35270

Weekly Support Levels: 1.31578, 1.32134

The weekly chart shows a bearish divergence as the price respects the previous support level (1.35270), acting as a resistance to the price.

The signal line on the stochastic indicator shows that price has entered an overbought zone, and we expect a reversal of price from those levels.

A close below the 1.31573 support will likely push the price further down.

Daily Outlook: Bullish

Daily Resistance Levels: 1.37130, 1.35116, 1.34041, 1.33360, 1.35504

Daily Support Levels: 1.32070, 1.32349, 1.31578

A daily overview shows that the US dollar is weak against the Singapore dollar as the pair formed a descending triangle pattern.

The support levels of 1.34041 were held for days, while the highs are getting lower every day, suggesting that the price will likely close below the group for a bearish rally towards the 1.33360 support zone.

If the support zone should hold, it will interest the Singapore broker to trade upwards for a bullish run that will likely expose the resistance level of 1.35504.

Bullish Scenario:

A bullish scenario can come to play if we see the price bouncing from the support level of 1.34041 to the upside.

Bearish Scenario:

In recent times of the market, the bears have dominated the market, and a close below the daily time frame support (1.34041) will mean that the bearish trend will continue.

Conclusion

The Singapore broker will closely monitor Jerome Powell and Treasury Secretary Janet Yellen’s testimony before the Senate Banking Committee because the outcome will determine the direction for the pair in the future.

The price is in a psychological zone on the daily chart, and we expect a close below the area for another bearish rally or to bounce or a bullish swing.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021