EURUSD Technical Analysis for Singapore

Contents

Introduction

The fear of a resurgent COVID-19 is what some online broker such as OlympTrade, the major economies, and upcoming economies do not want to experience again, having gone through a hash condition and global economic breakdown.

Fundamentals

Euro Zone

Final Core CPI y/y

Forecast 0.2% while the previous was 0.2%.

The infection rate is of concern to the Europeans as they want to cut down the numbers of affected persons having experienced the effect of the pandemic to business and other sectors.

The report shows changes in the prices of goods and services that consumers purchase, excluding items like tobacco, alcohol, and food, among others.

U.S.

Core Retail Sales m/m

The Core Retail Sales report is generated by the Census Bureau, considering the citizens’ spending trends through sales of items and commodities at the retail levels, thereby excluding anything that has to do with automobiles.

When the reports are released, if the actual data is greater than the forecast, it is bullish for the U.S. dollar, but if the data is lower than the estimates, it means a bearish run for the currency.

The forecast is 0.4% while the previous was 0.7%

EURUSD Technical Analysis

EUR vs. USD Bigger Picture: Bullish bias

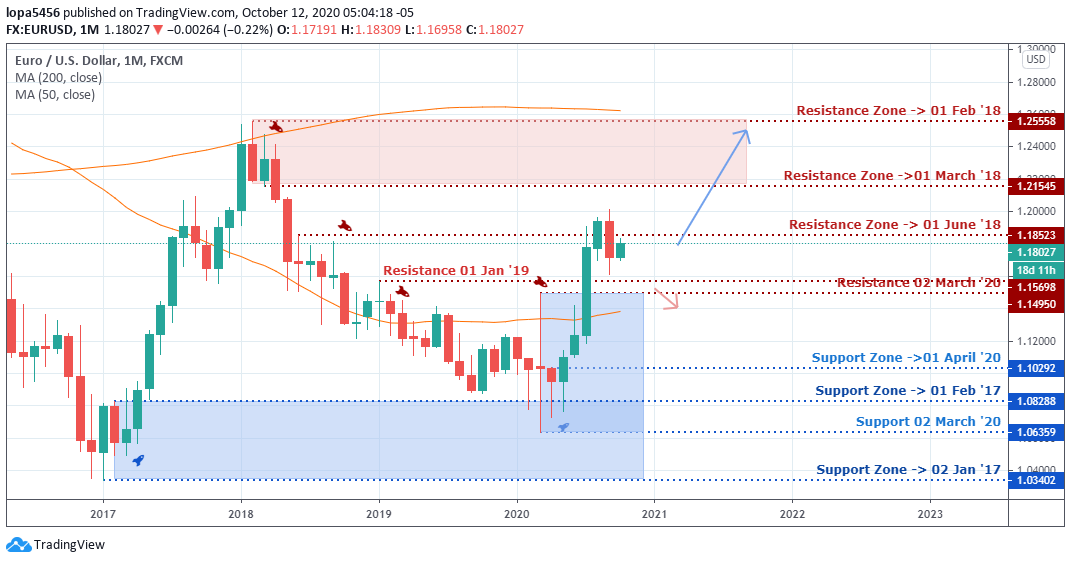

Monthly Chart

On the monthly chart, the bullish surge is still in an uptrend as the new month candle started on a bullish note after the previous month’s candle closed bearish.

The month is still early for the online traders to ascertain a continuation of the bullish trend, or we get a bearish bias month, which can put the 1.15698 level under threat while a close above the 1.18523 level may take the price to 1.21545 and above.

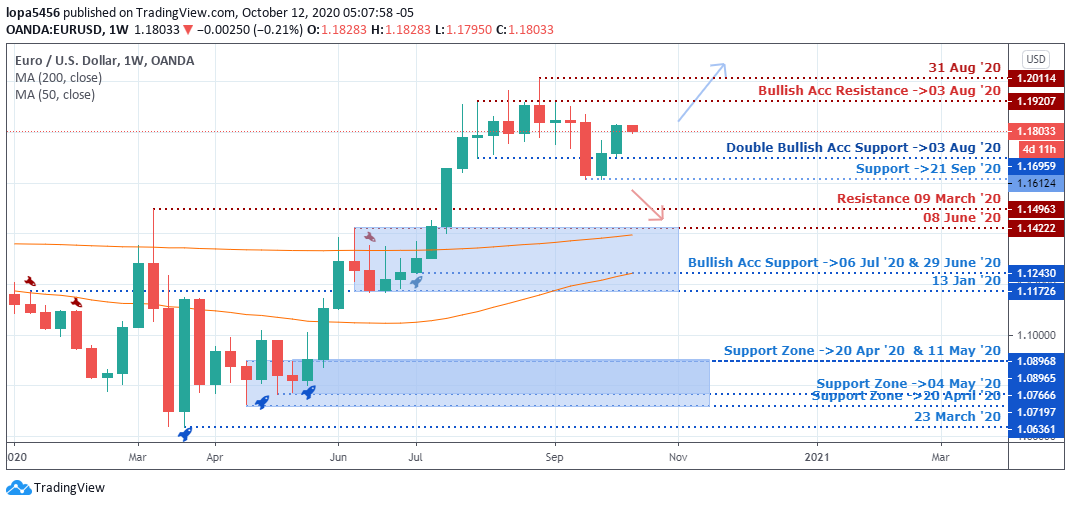

Weekly Chart Bullish

Weekly Resistances: 1.20114, 1.19207

Weekly Supports: 1.12430, 1.16959, 1.14963

You can see that the weekly time frame is bullish in nature, having broken above the 1.14963 resistance levels to create a new high of 1.20114 some weeks ago. If the bullish run from the support level of 1.16959 should have momentum, we shall see the price close above the 1.20114.

However, the bearish sentiment is still possible within the 1.19207 levels should they succeed to repel the bull’s advancement with a close below the 21st September price of 1.16959, which will expose the previous level of resistance 1.14963 turned support.

EURUSD Mid-Term Projections: Bullish

Daily

Daily Resistance: 1.19163, 1. 20111

Daily Support: 1.16122, 1.16960

The Bulls rally from the support zone of 1.16122 pushed the price up to the 1.19163 resistance zones at report time. If they break above the highest resistance of 1.20111, we shall expect the EURUSD pair to surge higher.

The present level of price has been a battleground for both bearish and bullish sentiment for the past 50 days as we can see that they both push the price in either direction. Therefore, we may see another swing to the low some days before we have a clear breakout from the range.

H4

H4 Resistance: 1.18282, 1.18618, 1.19175

H4 Support: 1.16110, 1.16544, 1.16940, 1.17416

The bullish swing from the 25th September low (1.16110) took the pair to the previous resistance zone of 1.18618, touching the 200 moving average, which may act as a resistance against the rising price.

If the resistance should hold, we may see the price drop down to the support zones of 1.17416.

Bearish Scenario:

A general bearish scenario on the four-hour and weekly time frames can be seen, we expect the build up to continue on the H4 resistance levels of 1.18282 and 1.18618.

Bullish Scenario:

A general bullish scenario based on four–hours can continue if the bullish run can overrun the resistance zones on the H4 and daily time frames (1.18282, 1.18618).

Conclusion and Weekly Price Objectives

The EURUSD pair is within a range from the daily time frame, having failed to breakout below the support levels of 1.16122 and finding it challenging to close above the resistance levels of 1.20111.

The online broker will be paying close attention to the U.S. presidential election coming up soon, and the Euro zones as well will be watching out for the outcome.

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021

Tagged with: EUR/USD