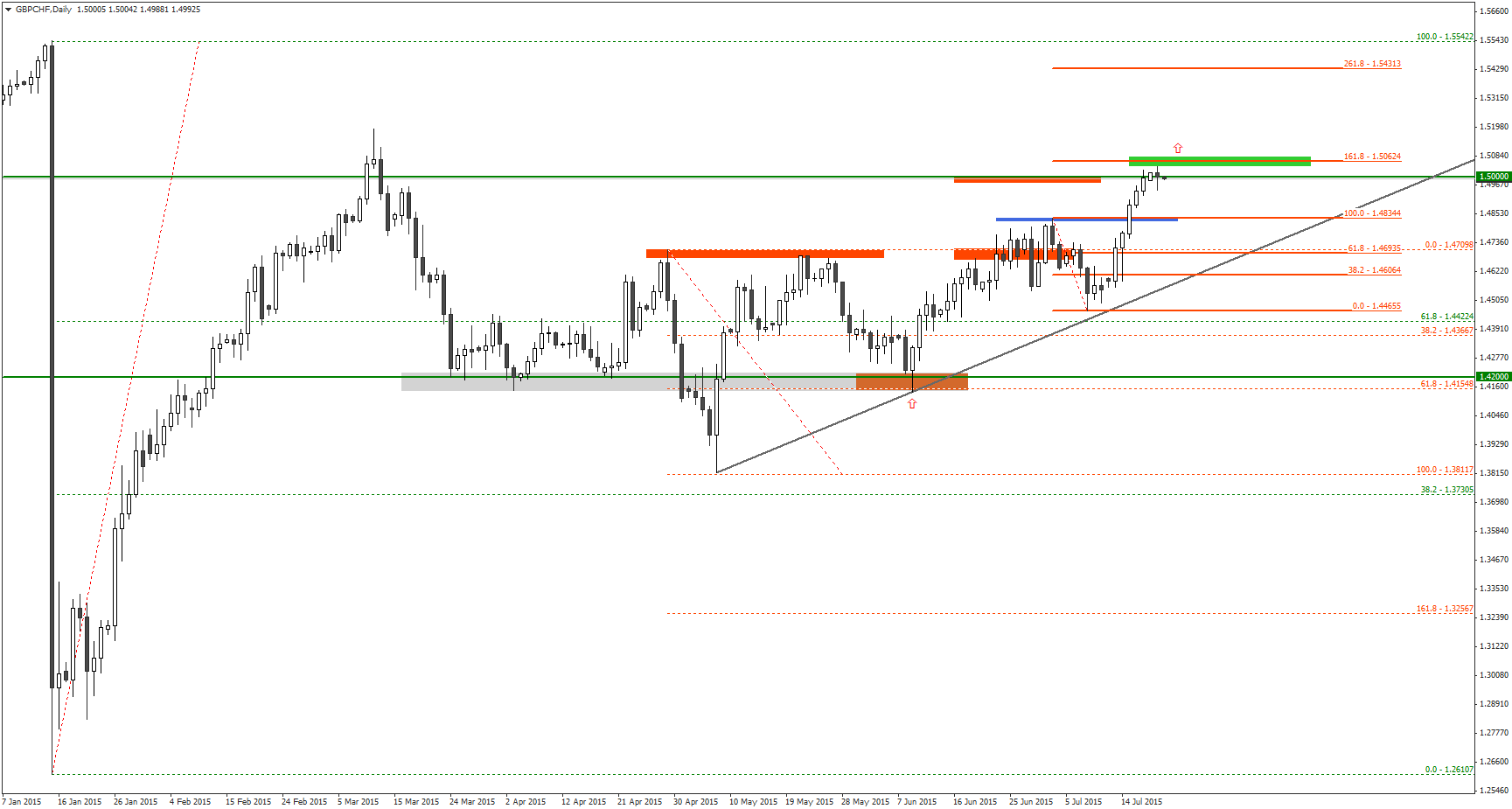

After making two profitable bullish recommendations for the GBP/CHF in a row, today, we will be once again discussing the GBP/CHF outlook. Since the pair has closed above the 1.4835 level on July 15, it has climbed over 190 pips in the past week. It also reached near the 161.8% Fibonacci extension level of the last downward swing towards the uptrend line.

The GBP/CHF is now trading near the important psychological pivot zone and a Big Round Number (BRN) 1.5000.

However, On June 20, it formed a Doji looking candlestick, indicating that binary options buyers and sellers are indecisive about moving the price in either direction at the moment.

Today, the Swiss Federal Statistical Office will release its monthly trade balance figure, which is expected to decline to 2.54 billion against last month’s 3.41 billion. On the other hand, the UK’s Office for National Statistics will release its retail sales figure on Thursday, which is expected to come at 0.4% increase compared to 0.2% increase in the last month.

Therefore, the fundamental outlook for the GBP/CHF would remain bullish for this week, unless the actual figures diverge immensely compared to the forecasts.

Although the Doji bar suggests tentativeness in the market, as the current GBP/CHF has an established bullish trend, binary options traders should only consider placing CALL orders for the time being.

Under the circumstances, it is recommended that traders place a CALL order for the GBP/CHF with their binary options brokers once the price closes above the 1.5063 level.

Recommended Binary Options Brokers

[bonustable_fixed site1=’8′ site2=’333′ site3=’120′ site4=’189′ ]

Tagged with: Free Signal • GBP/CHF