Binary Options Signal Alert for EURCAD

Price volatility concerning the Euro pairs in the global binary options market has increased this week. As there was a possibility that Greece will default on its US$ 1.7 billion loan payment to the International Monetary Fund, the EUR/CAD opened on Monday with a huge gap of around 187 pips.

Earlier this Monday, a rumor regarding a possible deal with the leftist government of Greece with its international creditors helped create a rally. As a result, the EURCAD was up around 400 pips by the end of June 29.

The media reported that the Greek Finance Minister, Yanis Varoufakis, talked to several key European leaders over the phone at the last minute and asked for another bailout worth US$ 32 billion for the next two years. While European Finance Ministers agreed to discuss the matter again on Wednesday, there were no new deals made over the phone.

As the deadline to make the loan payment was on June 30, as of this morning, Greece has officially defaulted on its installment payment to the IMF.

As the worst possible outcome regarding the Greek issue has already materialized, it appears that the binary options market has already weathered the economic outcome of a possible default by Athens.

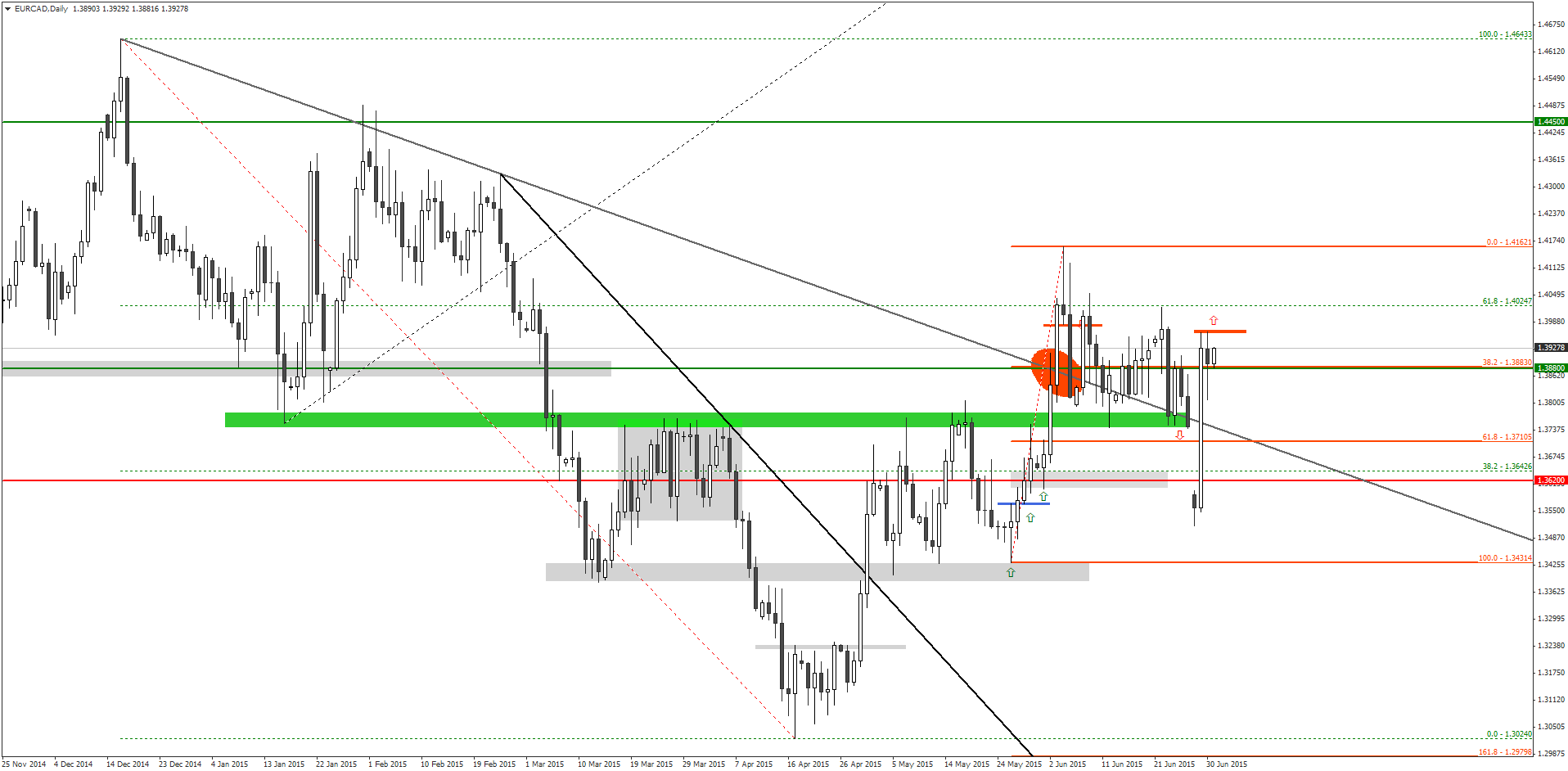

Currently, the EUR/CAD trading above the psychologically important pivot zone around 1.3880.

If the EUR/CAD price continues to climb higher over the next few days, it would signal an additional rally towards the 1.4162 level. However, it is strongly recommended that traders wait for the EUR/CAD price to penetrate and close above the 1.3970 level before placing any CALL orders with their binary options brokers.

Tagged with: Binary Options Signal • EUR/CAD