EUR/USD analysis October 25 , 2017 for Binary Options

Contents

Fundamentals

The EUR/USD currency pair is one of the most prominent currency pairs in the world. While, the pair closed lower in the past week, on Tuesday 24th of October, the EUR/USD ended the day on a strong note and remained bullish. According to experts, the EUR/USD pair is now looking to establish a base that’ll further help it in moving higher for a short period of time. However, with the ECB press conference scheduled to be held next week, traders and binary options brokers may witness increased volatility, which may further drag EUR/USD in almost any direction, depending upon how the European Central Bank views the entire situation.

On Monday, the pair experienced low volatility, even as the traders as well as the brokers returned to the market and began preparations for the week ahead. However, as the week moves ahead, both the brokers and the traders will be patiently waiting for the outcome of the ECB meeting that’ll further provide the pair with some direction and momentum for a brief period of time.

It must be noted that the European Central Bank had earlier indicated that it would gradually reduce the Quantitative Easing. However, the bank hasn’t been very aggressive since then. The traders, on the other hand, are expecting that the ECB would taper the Quantitative Easing process. Market and financial experts are of the opinion that the European Central Bank may go slow around its QE process, which would then put the European currency under some amount of pressure for a brief period.

Technicals

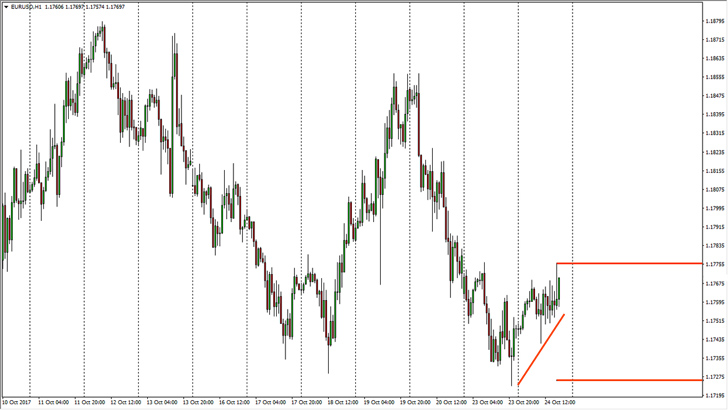

For the past couple of weeks traders have been extremely cautious about trading the Euro. As a result the currency has been trading within a weaker range. On Tuesday, the pair stood near a range of 1.1760 and, however, it may receive some support if it hovers around the range of 1.1680. On Tuesday, however, the pair was largely driven by the USD in the absence of fundamental updates and developments within the eurozone. On Monday, the pair dropped to lower levels and later bounced towards 1.1775. However, it dropped lower again to reach the 1.1725 handle and later bounced all over again.

If the pair drops lower further, then that would send the market lower at 1.15 levels and thus it’s quite possible that the US dollar would strengthen in the near short period of time. As far as the USD is concerned, the currency is being oversold in the past couple of months and may gain strength further. However, it the market went up and beyond the 1.18 level, then the conditions would get extremely bullish and it would further send the market towards the 1.20 mark or above.

Currently, the EUR/USD market is extremely volatile and there’s a great deal of speculation around the Fed, which is further looking very aggressive. This would break the paid down further and it won’t remain as bullish as it was expected to remain before. Keeping this at the back of our mind, we strongly feel that traders need to be extremely cautious about placing their trades, especially in terms of size.

Our Recommended Binary Options Brokers to trade EUR/USD:

Best Regulated Broker

IQ Option is the world’s leading EU regulated financial broker based with a revolutionary platform for all traders. Read IQ Option review

- Best Trading App for Binary Options

- Minimum Deposit of only $10

- Minimum Trade of $1

- Trusted Broker

- $10,000 Virtual Funds ( Demo Account )

- Quick Withdrawals

- Outstanding Platform

- Weekly Tournaments

- Gain up to 98%*

Top US Broker: BinaryCent

- Trade Binary Options & CFD

- Up to 90% Payout

- Trades from $0.10

- 24/7 Live Video Chat

- 1-Hour withdrawal

- Up to 100% Deposit Bonus + 3 Risks Free Trades

- $20,000 Weekly Contests

RISK WARNING

Your capital may be at risk. This material is not investment advice

- EURUSDWeekly outlook – 7th January 2022 - January 7, 2022

- BTCUSD – Weekly outlook for Bitcoin Price – 23rd December 2021 - December 24, 2021

- USDSGDWeekly outlook for Singapore Dollar – 17th Dec 2021 - December 17, 2021